Market View - 3rd Quarter 2022

“It is hard to argue that investors are bullish. The Bank of America survey shows that optimism among fund managers about the economic outlook is at an all-time low. Can a hard landing be avoided? Even Mr Powell sounded rather unconvinced. Prepare for more trouble ahead.” The conclusion to an article titled, “Eight days that shook the markets” from The Economist newspaper 18th June.

LAST QUARTER REVIEW

The second quarter of 2022 saw inflationary data in the United States and western economies continue to worsen and, in response, the Federal Reserve (Fed), voted to increase base rates by 0.75%. The June interest rate move by the Fed was the third consecutive increase following its Federal Open Market Committee (FOMC) meetings this year and biggest single rise by the American central bank since 1994!

The continued sanctions imposed upon Russia are exerting additional upward pressure on the price of basic commodities such as oil, gas and foods. The combination of continuing commodity price inflation, declining economic growth and increasing interest rates served to raise the prospect of recession with the potential for longer-term stagflation.

Last quarter, Wall Street’s 2022 decline accelerated as the Dow Jones Industrial Average (DJIA) declined more than 11% and has declined more than 15% year to date (YTD), while the S&P 500 fell more than 16% and is down almost 21% YTD, and the technology heavy Nasdaq 100 has fallen more than 22% in the last quarter and more than 26% YTD. This is the worst first half year performance for the DJIA since 1962, the S&P 500 since 1970 and the Nasdaq since the index was launched, while the domestically focused Russell 2000 index is also in bear territory having fallen almost 17% last quarter and almost 25% YTD.

Most European equity markets also find themselves in bear market territory having fallen by 20% or more at some stage this year. The one exception is the UK FTSE 100 index, which fell by less than 5% over the last quarter and less than 3% YTD by virtue of so many of its constituents’ comprising commodity and resource-based companies with global operations. UK mid and smaller company sectors fared rather worse as both FTSE 250 and the FTSE Small Cap fell by 12% and 10% respectively during the quarter (more than 20% and 16% respectively YTD).

In the UK bond market, the selloff that we saw in the first quarter continued as the yield on the benchmark 10-year gilt rose from 1.60% to 2.25% (hitting 2.6% at one stage in June, the highest since July 2014) as the Bank of England (BOE) raised its main Bank Rate by 0.25% to 1.25% during its June 2022 meeting, a fifth consecutive rate hike and pushing borrowing costs to the highest in 13 years in its effort to curtail inflation.

Interestingly, three of the nine members of the BOE’s Monetary Policy Committee (MPC) voted for a bigger interest rate increase of 0.50% as the central bank raised its commitment to bring inflation back to the 2% target. The BOE expects inflation to be over 9% during the next few months and to average slightly over 10% at its peak in the fourth quarter of 2022, while GDP growth is seen slowing sharply in the short term and coming in at -0.3% in the second quarter, before turning positive again by the end of the year.

During May, annualised inflation rate in the US rose to 8.6%, the highest since December of 1981, as energy prices increased 34.6%, the most since September of 2005, and food costs increased by 10.1%, the first time that double digit inflation had been experienced in what Americans eat since March 1981. Other large increases were seen across the economy including sectors such as airline fares (37.8%) shelter (5.5%), household furnishings and operations (8.9%), and used cars and trucks (16.1%)

The European Central Bank (ECB) also stated its intention to begin raising interest rates at its July meeting in order to counter rising inflation in the Euro zone, while at the same time announcing it will end its net asset purchases under its APP at the next meeting. Inflation in the Euro Area was at a record-high of 8.1% in May of 2022 compared to its stated target of 2% annualised, as prices goods and resources across the economy increased including energy (39.1%), food, alcohol & tobacco (7.5%), services (3.5%) and non-energy industrial goods (4.2%)

In China, the People’s Bank of China (PBOC) maintained the interest rate on its benchmark corporate and household loans with the 1-year loan prime rate (LPR) at 3.7% while the five-year rate, a reference for mortgages, was also maintained at 4.45%, following a record 15 basis point cut in May. China’s cabinet stated that the country will not be replicating the massive fiscal and monetary stimulus adopted by western economies in response to the pandemic, notwithstanding that borrowing demand by households and companies remains weak due to the pandemic-induced slump and a months-long property downturn.

Currency markets saw the dollar DXY index (a basket of foreign currencies) close the quarter at 104.75 (up from 98.37) reflecting the global reserve currency’s popularity against other fiat currencies on rising US interest rates. The dollar was especially strong against sterling (1.22 from 1.31) and the euro (1.048 from 1.110) with some commentators suggesting that should parity be reached with the latter, the global bear market in equities could gather increased momentum.

In energy markets, the oil price was less volatile than during the first quarter as it peaked at more than $120 a barrel before settling at $105.86 having begun the period at 101.43 on the 1st April. The price appears to have settled at around $110 a barrel on the basis that aggressive monetary tightening in major economies aimed at curbing soaring inflation could lead to a global recession and damp oil demand

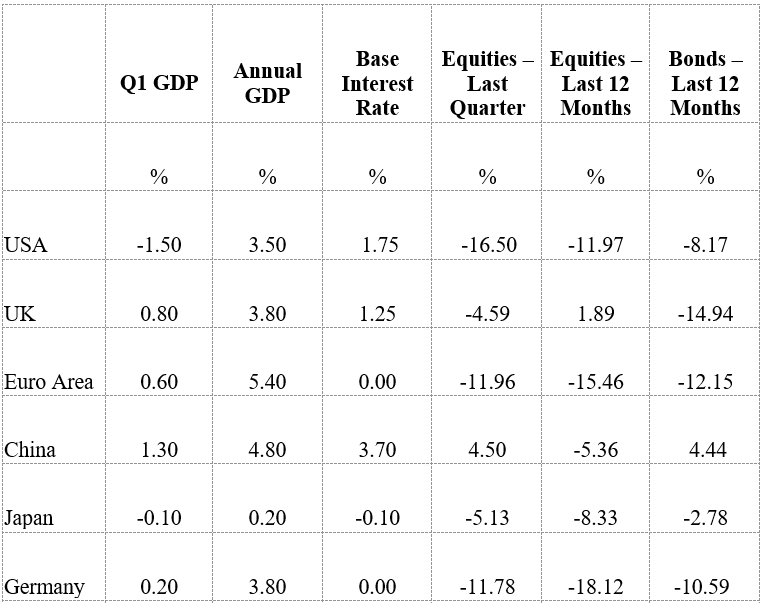

GDP Data shown are to the 31st March 2022; Interest Rate, Equity & Bond Index Data are to the 30th June 2022; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzhen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Sovereign Bond Indices used: S&P US T-Bond, S&P UK Gilt Bond, S&P Eurozone Sovereign Bond (Eur), S&P China Bond, S&P Japan Government Bond, S&P Germany Sovereign Bond.

CURRENT CONSIDERATIONS

Markets are now totally focused upon persistent inflation with the determined actions of the central banks concentrated on maintaining control of economies both in the United States and globally. Inevitably the old saying “be careful you don’t throw out the baby with the bathwater” comes to mind as memories of seventies stagflation loom large in the rear-view mirror of many investors and market analysts.

A combination of excessive fiscal stimulus post Covid in most Western economies, along with an exaggeration of the supply shortage following the Ukrainian conflict, and potentially an overly relaxed stance from central banks who belatedly have sprung into (over) action has resulted in inflation levels not seen for decades in the West! In the markets, benchmark bond yields in America, UK and Europe have been soaring, while bear markets have been triggered on Wall Street and several other major equity markets.

Interestingly, as recorded in The Economist article (mentioned at the beginning of this commentary), Jerome Powell remarked on the 15th June, “I do not expect moves of this size to be common.” The Economist article explained how the Fed’s interest-rate decision came at the end of an extraordinary eight days in financial markets, in which bond yields shot up at a violent rate, share prices plunged and riskier assets, notably bitcoin but also Italian government bonds, were trashed.

The article suggests that the eight-day shock began in Sydney where, on June 7th, the Reserve Bank of Australia in an attempt to curb inflation raised its benchmark interest rate by 0.50%. Then the ECB arguably shocked markets further when Christine Lagarde confirmed that the central bank would not only raise its interest rate from zero to 0.25% in July, but that she expected that they would raise interest rates perhaps by another 0.50% to 0.75% in September while anticipating “sustained” increases thereafter.

From that statement, bond markets began to respond adversely with the yield on the benchmark 10-year German bund rising quickly to 1.75% while riskier euro member bonds such as Italy saw an even more dramatic increase in longer term interest rates at 4%! However, the article confirms that while all these events were worrying markets, it was when the news came that May’s inflation in America was 8.6%, traders on Wall Street knew a bear market had well and truly arrived!

As we suggested in our last Market View, the inversion of the US Treasury yield curve that began towards the end of March suggests the Fed is walking a tight rope that now looks almost certain to bring on a recession as a result of its interest rate actions. During the last quarter the US Treasury yield curve has been inverting and then un-inverting regularly, and while as yet the 2-year and 1-year notes have marginally avoided inverting, it is likely to be just a matter of when rather than if this occurs as the Fed embarks upon further aggressive monetary action.

The US Treasury bond market has proved incredibly reliable when it comes to forecasting recessions as evidenced by several research papers and blogs over the past few years from the St. Louis Federal Reserve that shows every recession since 1957 has been preceded by a yield curve inversion. The St Louis Fed research observes that the lag between the inversion and a recession varies with the lag for the 10-year and 1-year yields being between 8 and 19 months, with an average of about 13 months.

Effectively, an inverted yield curve signals that investors believe current growth is stronger than future growth, which makes a recession more likely as businesses and investors slow spending and investing because of their decreased expectations. As to what type of global recession is likely to result from the actions of the Fed, the BOE, and other central banks, this has been a matter of debate and conjecture by market analysts and investors.

Many observers point to similarities between today’s predicament and the early 1980s, when Paul Volcker’s Fed crushed inflation, causing a deep recession in the process. However the global economy is starkly different today to what it was forty years ago with energy costs (while still important) playing a lesser role than they did back then and of course total debt owned by governments, corporations and individuals almost paled into insignificance in comparison to today, giving the Fed plenty of scope to raise interest rates to almost 20% to achieve its objective under Volcker.

Others are comparing today to the technology bust in 2000, and the subsequent recession following the market collapse on Wall Street and loss of confidence in the global economy with so many stocks becoming either worthless or being dramatically down valued. However while the dramatic revaluations of some highly valued tech stocks this year as reflected in the fall in value of the Nasdaq index bears some similarities to what occurred two decades ago, the cause of the global slowdown this time are more complex and are arguably related to the pandemic induced recession of 2020 and the subsequent unprecedented fiscal and monetary stimulus that western authorities used to try and kick-start the global economy.

FORWARD OUTLOOK

While arguably the Fed should have raised interest rates sooner, its likely panicked subsequent over-reaction looks destined to ensure a recession is on its way both in the US and globally. The US Treasury bond market and eurodollar futures market (both of which have an impeccable forecasting record) are confirming this likelihood.

The key questions to try and answer as we seek to risk proof portfolios in so far as it is possible, are how soon the recession will happen, how long will it last, how much further will equity markets on Wall Street and elsewhere potentially fall, and when will the stock market recovery commence. The first of the four questions posed here is (based on the history researched by the St. Louis Fed) the easiest to try and determine since the analysis showed that since 1957, the lag between the inversion and a recession (for the 10-year and 1-year yields) as being between 8 and 19 months, with an average of about 13 months.

This suggests that since the US Treasury 10’s – 2’s have not yet inverted, let alone the 10’s – 1’s (which was the spread most closely analysed by the Fed economists) we are looking at the second or third quarters of 2023 as the most likely time for the US recession to arrive. Of course Wall Street price action will likely discount the recession by at least 6 months since the institutional investors and market makers who dominate American stocks will also be closely watching the yield curve, which suggests we could have one more potentially severe leg of this bear market to endure this autumn or winter before the likely commencement of a new bull market.

The potential timings and severity of our projected scenario will of course be dependent upon how quickly the Fed and other central banks can regain the confidence of, not just investors, but the population at large by reigning in inflation with future expectations from year to year returning to 2% per annum or thereabouts. Failure on this count and a perception that future annual inflation is more likely to be the current 8%-9% and all bets are off with regard to the likely duration and severity of both the recession and equity and bond bear markets.

Meanwhile, what we can expect in the run-up to recession in the US, UK and global economies, is continued strength of the dollar and a continuing and progressively deeper inversion of the US Treasury yield curve as investors fleeing the uncertainty of global equity markets and non-US sovereign and corporate bond markets seek safety in both of these asset classes. Since institutional investors are likely to anticipate weaker global economic growth and a potential return to disinflation or even deflation post-recession, they are likely to discern better relative value at the longer end of the US Treasury curve, hence keeping yields relatively suppressed on government notes and bonds of this duration even as the Fed increases interest rates at the short end driving up the yield on T-bills.

With these considerations in mind we are reminded of one of the most often quoted sayings of Warren Buffett, namely, “be fearful when others are greedy, and greedy when others are fearful.” This suggests that investors can maybe benefit from timing the market and trying to sell some of their equity holdings in scenarios such as earlier this year when the Fed in order to fight inflation began raising interest rates, before buying back near the bottom when the recession has arrived.

Of course that would be much easier said than done and whenever the famous Buffett quote is repeated, it is very rare for the second part of his advice to be mentioned, namely “if you are going to insist upon trying to time your participation in equities.” For most investors, history has shown buy and hold is a much more successful strategy with the occasional fine tuning when appropriate.

Accordingly, we shall keep a close eye on developments and in particular any changes in the US Treasury yield curve and investor sentiment with respect to inflation in order to determine when might be an opportune time to add further equity exposure from the current percentage sitting in cash. We continue to believe that equities offer the most attractive opportunities on a relative valuation basis (risk reward, yield and liquidity) when compared to investment grade government and corporate bonds, property and alternatives (including infrastructure, private equity, commodities, precious metals).

In uncertain markets like these, maintaining a well-diversified and balanced portfolio is fundamental. Where appropriate, we will look to decrease allocation to growth funds (with the exception of energy and resources companies in the commodity sector where we expect the outlook to remain positive) and reallocate to more defensive oriented funds aligned to value and income.

Additionally, we remain comfortable in continuing to include some exposure to balanced Fixed Interest funds investing in a combination of blue-chip government debt markets (primarily US Treasuries and UK gilts) and investment grade corporate debt exposure. As always, investment risk is at the forefront of our advice and, whilst it is often necessary to undertake adjustments in portfolio allocation to maintain individual preferences, we are confident that our advised portfolios remain well placed in meeting our clients’ needs.

Copyright © Ash-Ridge Asset Management 1st July 2022.

Data Sources: Bloomberg; Brookings Institute; Economic Cycle Research Institute: Financial Sense; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macro Voices; National Bureau of Statistics China; Office for National Statistics; Real Vision; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal; Zero Hedge.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has been advising me for over 25 years. I have seen a very significant increase in the value of my portfolios over the years and have been very impressed by their professionalism, attention to detail, hands on management and care. I have been thoroughly pleased with the service so far.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.