Market View - 1st Quarter 2021

“There are stock traders who are genuinely good and not merely lucky. But the number of investors who can trade in and out of shares frequently and profitably is vanishingly small. The “Learning from Noise” study shows how easy it is to convince yourself that you are one of them. But it is probably wise to assume that you are not.”

– Concluding paragraph from a recent article in The Economist titled, “C’mon feel the noise – How retail investors often learn the wrong lessons from success.”

LAST QUARTER REVIEW

The last quarter proved a phenomenally positive one for global equity markets powered higher by a combination of traditional seasonal goodwill, further fiscal stimulus in most major western economies to plug the gaps from further Covid induced lockdowns, hopes for a pandemic vaccine cure, and at long last a post Brexit trade deal between the UK and EU. The historic trade agreement includes zero tariffs and quotas, a five-and-a-half-year transitional period on fish quotas and maintains fair competition with the UK, in line with EU standards.

The added good news this quarter about the equity bull market was that the UK finally joined the party as the FTSE 100 rose more than 10%, but was vastly overshadowed by the performance of both the mid-caps and smaller companies section of the market which rose 18% and 23% respectively. The recognition of the value in second tier and smaller companies was echoed across the pond in America as the Russell 2000 proved the best performing section for investors as the mid and small cap index rose over 30% during the quarter.

All three main stock indexes in the US reached further record highs in late December following President Trump unexpectedly signing the near $900 billion coronavirus relief package into law after having criticized it the previous week. The President also signed an additional $1.4 trillion in government spending to fund federal agencies through to the end of the fiscal year in September 2021.

Earlier in December, the Federal Reserve (Fed) left the target range for its federal funds rate unchanged at 0-0.25% as had been expected during its Monetary Open Market Committee (MOPC) meeting, and said it was likely to remain at this level until at least 2023. The Fed also said that it will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward employment and inflation.

Regarding new economic projections, the Fed sees the US economy shrinking less than previously forecast in 2020 (-2.4% vs -3.7% quoted in September) and expand at a faster pace in both 2021 (4.2% vs 4.0%) and 2022 (3.2% vs 3.0%). The American central bank expects PCE (personal consumption expenditures) inflation to remain unchanged at 1.2% in 2020, and slightly higher next year (1.8% vs 1.7%) and in 2022 (1.9% vs 1.8%), while it expects unemployment to be lower at 6.7% in 2020 (vs 7.6%), 5% in 2021 (vs 5.5%) and 4.2% in 2022 (vs 4.6%).

Meanwhile, the number of Americans filing for unemployment benefits decreased to 803,000 in the week ended December 19th, from the previous week’s three-month high of 892,000, and compared with market expectations of 885,000. This number however remains well above the 200,000 level reported pre-Covid back in February and will likely remain elevated for some time as the pandemic is far from controlled, although vaccination has now begun in the United States.

In the UK, the EU trade deal ended months of negotiations following Brexit on January 31st, and came just days ahead of the end of the transition period on December 31st. The post-Brexit trade deal between the UK and EU has now been signed into law and took effect at 23:00 GMT on New Year’s Eve, after Parliament overwhelmingly backed the Christmas Eve agreement in a high-speed process on the 30th December.

Meanwhile at the Bank of England (BOE)’s Monetary Policy Committee (MPC) meeting in December, the MPC voted unanimously to maintain Bank Rate at 0.1%. The Committee also voted unanimously for the BOE to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £20 billion, and the stock of government bond purchases at £875 billion, making the total target stock of asset purchases £895 billion.

On the 25th November, Chancellor Rishi Sunak delivered the UK’s Spending Review and the Office for Budget Responsibility (OBR) released its latest projections for the British economy. The government is expected to have borrowed £394 billion (19% of GDP) in 2020, the highest level of borrowing in peacetime history, while GDP is set to contract 11.3%, the most for the past 300 years, and output is not expected to return to pre-pandemic levels before the end of 2022.

Elsewhere in the UK economy, the Halifax house price index rose 7.6% from a year earlier in November 2020, the largest annual increase since June 2016, as the UK property market continued to show signs of recovery from the coronavirus-induced restrictions. House prices had increased 6.5% since June, the strongest five-monthly gain since 2004, albeit Russell Galley the MD at Halifax warned that, “with unemployment predicted to peak around the middle of 2021, and the UK’s economy not expected to fully recover the ground lost over 2020 for a number of years, a slowdown in housing market activity is likely over the next 12 months.”

In Europe, the European Central Bank (ECB) expanded its Pandemic Emergency Purchase Programme (PEPP) by another €500 billion and extended it to at least the end of March 2022 at its December monetary policy meeting, aiming to support the Eurozone’s struggling economy amid the coronavirus crisis. Moreover, policymakers approved more long-term loans on cheap terms for another year until June 2022, and announced four additional pandemic emergency longer-term refinancing operations to be offered in 2021.

The main refinancing rate was held at 0% while the deposit rate remained at a record low -0.5%. Meanwhile, the outlook for economic activity has been revised down in the short term, with 2021 GDP expected to be just 3.9% and inflation only 0.2%.

In the currency markets, the US dollar lost more than 4% of its value against a basket of currencies as measured by the popular DXY index, while sterling gained almost 6% against the greenback primarily due to the Brexit trade deal result. Gold bullion as measured in dollars was little changed over the quarter while oil (West Texas Intermediate) climbed more than 20% to almost $50 on the back of economic growth hopes, and declining reserve stocks.

CURRENT CONSIDERATIONS

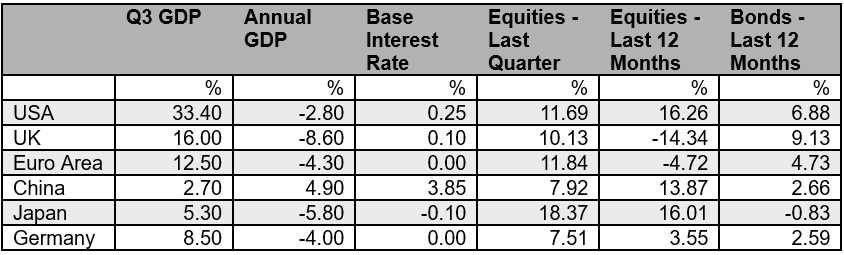

GDP Data shown are to the 30th September 2020; Interest Rate, Equity & Bond Index Data are to the 31st December 2020; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Sovereign Bond Indices used: S&P US T-Bond, S&P UK Gilt Bond, S&P Eurozone Sovereign Bond (Eur), S&P China Bond, S&P Japan Government Bond, S&P Germany Sovereign Bond.

The US recession induced by the arrival of the Covid-19 pandemic in mainland America last March now looks to be over, and was probably the shortest in history (according to Investopedia the previous shortest was the “The Energy Crisis Recession” which lasted 6 months between January and July 1980). If this turns out to be true, it will resonate with the shortest equity bear market in history which commenced on the 9th March (when the 7.6% daily fall took the benchmark S&P 500 more than 20% lower than its closing high of 3386.15 on the 19th February) and ended a month later on April 8th, when the S&P 500 closed more than 20% higher than the March 23rd closing low of 2,237.40.

While technically the recession has ended, the recovery is unlikely to be a classic V shape, and will likely take a long time and be more gradual than previous business cycle recoveries. Historically the stock market predicts in advance both the beginning and the end of a recession and the 2020 pattern has been no different with incredibly the bottom established on Wall Street way back in March, just several weeks effectively after the market had identified the top earlier in the year.

We are however seeing worrying inflationary signs as the US and global economies slowly recover, but as ever the key question is whether this inflationary uptick is simply another cyclical one similar to that seen in the 2016-18 period, or a paradigm shift from secular deflation to inflation? Even the Fed appears to have been wrong footed in the past decade into thinking what turned out be temporary cyclical upturns were here to stay.

In 2016 the US experienced the strongest growth since 2010, providing the catalyst for synchronised global growth, which in turn lead policymakers headed by the Fed to almost ecstatically proclaim a structural change had occurred with an end to the era of low trend growth, low inflation, and secular stagnation. This in turn arguably led the Fed to a costly policy error of beginning to raise interest rates in 2018, not realising that what had occurred was simply an inflation cycle uptrend (which subsequently reversed), and not the beginning of a new secular inflationary trend.

Consequently in the summer of 2018, on the back of these erroneous economic evaluations, several respected “bond kings” and market analysts began urging investors to get out of bonds including safe haven US Treasuries (UST) as they anticipated long dated interest rates on benchmark 10 year and 30 year USTs rising to 4%, 5% or even 6% when at the time they stood at less than 3%. Hindsight subsequently showed that both GDP and future inflation indicators had both turned down in early 2018 proving there was no secular paradigm shift.

Rising inflation is most certainly here for the next couple of quarters at least, and could offer short term investment opportunities in sectors that should benefit, but longer term it is more questionable since ever increasing debt service costs have been such an important deflationary factor over the last couple of decades. It is difficult to imagine higher sustained interest rates being possible in that scenario, but should the incoming US administration under Joe Biden decide to introduce MMT (modern monetary theory) and Congress approves a change in the Fed’s monetary authority that enables it to monetise all the money created by the Treasury, then all bets will be off as to whether a new secular inflationary period has begun.

Inevitably, the impact of the additional stimulus in the US and elsewhere to counter the effects of the Covid pandemic on the global economies has led to strains on the global reserve currency the US dollar. Investors were reassured therefore when on the 16th December, the Fed announced the extension of its temporary US dollar liquidity swap lines and the temporary repurchase agreement facility for foreign and international monetary authorities (FIMA repo facility) until September 30, 2021.

These facilities were temporarily established in March 2020 to ease strains in global dollar funding markets resulting from the COVID-19 shock and mitigate the effect of such strains on the supply of credit to households and businesses, both domestically and abroad. The Fed press release explained that a further extension of these facilities will help sustain recent improvements in global US dollar funding markets by serving as an important liquidity backstop, and additionally, the FIMA repo facility will help continue to support the smooth functioning of the US Treasury market by providing an alternative temporary source of US dollars other than sales of securities in the open market.

Meanwhile in the UK, the announcement of the new post Brexit trade deal with the EU could not have come at a better time following the warning from Chancellor Rishi Sunak to parliament in late November of the impact the Covid lockdowns have had on the British economy. The Chancellor warned that the British economy looks set to contract by more than 11% in 2020, the biggest annual contraction in 300 years, a period that has included at least one other global pandemic, and many, many wars.

If anyone previously doubted it, the news confirmed that the UK has been one of the hardest-hit developed nations, with one of the highest COVID-19 death tolls in the world. As a consequence, British leaders have imposed some of the harshest restrictions on movement and businesses in all of Europe.

The silver lining is that as the UK budget deficit balloons toward a new post-war high, the Chancellor is focusing on providing support for jobs and the unemployed, plowing tens of billions of pounds into infrastructure spending, and trying to ensure the British health-care system is ready for another onslaught of patients.

It has also become apparent following the Covid black swan and its economic impact that those whom have fared better have been the computer internet savvy workers whom have the flexibility of being able to work from home when necessary, while sadly sectors that are dependent upon footfall and customers being able to occupy their services such as hospitality, transport and entertainment have been less fortunate. We can only hope that new opportunities will materialize for those employed in the latter category and that lots of new budding entrepreneurs will step up to the plate and ensure a healthy balanced economy come what may.

Regardless of what the future holds, the extraordinary resilience of the global equity market in 2020, led as usual by Wall Street stocks has proved that provided policymakers are sufficiently fleet-footed to contain economic fall-outs from black swan events, and manage to maintain the funding spigots, there will be plenty of opportunities for investment gain. The S&P 500 rose almost 15% in calendar 2020, while the tech heavy Nasdaq 100 was up almost 48%, and even the Russell 2000 (comprising mid and small cap US stocks) gained more than 18%, while the gains for these indices from their March bear market lows was an extraordinary 65%, 88% and 99% respectively!

FORWARD OUTLOOK

The challenge for investors as always will be (as The Economist observation we quoted at the beginning suggested), properly evaluating risk and maintaining a balanced all-weather portfolio. While the gains from global equity markets and especially those on Wall Street are spectacular in hindsight, we must remind ourselves that back in March during the depths of the global despair concerning the pandemic, fear of a capitulation of global equity markets was uppermost in the majority of investors’ thoughts!

Looking ahead, and with the EU trade deal finally resolved, the UK should be able to look forward to a much better 2021 economically, notwithstanding continuing Covid concerns. Provided the latter remains manageable both here and globally, we should see the gradual erosion of the discount (of at least 5% compared to global peers) that London listed stocks have traded at for most of the year.

Additionally the UK government’s recently announced plans to invest heavily in infrastructure and green initiatives should provide a further much needed boost to the economy and ample investment opportunities. The National Infrastructure Strategy (NIS) published on the 25th November sets out the exciting plans to transform UK infrastructure on an unprecedented scale and magnitude.

The NIS was presented to parliament by the Chancellor, and in the executive summary of the hundred page document that is subtitled “Fairer, Faster, Greener”, we learn that innovation and new technology will be at the heart of the government’s approach. The key strategies of the NIS will include, boosting growth and productivity across the whole of the UK, putting the country on the path to meeting its net zero emissions target by 2050, supporting private investment in these infrastructure initiatives and accelerating and improving delivery.

The executive summary explains the NIS will be underpinned by high levels of government investment, with record levels of money for the railways, strategic roads, broadband networks and flood defences. The document also explains that as every infrastructure sector could face transformative technological change over the next twenty years, new technologies have enormous potential to improve the environment and the daily lives of people across the UK, and the NIS will ensure the UK is at the forefront of this technological revolution.

Meanwhile in the US, there will inevitably be a mixture of excitement and apprehension for markets as we await the arrival of the new presidential administration. While doubtless some market commentators and investors will have been disappointed that a blue political sweep (that would have resulted in massive additional stimulus) did not occur, the silver lining will be that the enormous threatened tax increases the Democrats had proposed are now unlikely in a split Congress, while there ought to still be adequate consensus to agree upon the continuation of sizeable stimulus packages until the economy returns to normal.

While we remain optimistic about the potential offered to investors in 2021 by the combination of the resolution of the EU trade talks, the UK’s NIS initiatives and the new US administration, there are serious concerns that temper any over enthusiasm. These include the precarious government and corporate debt liabilities that exist in most major economies post Covid, and especially in the US, UK and EU.

Additionally stock valuations particularly on Wall Street remain at excessive levels by historical standards. Accordingly we shall be advising portfolios be more defensively positioned than for some time as we head into the New Year to ensure optimal risk-adjusted returns.

As always, investment risk is at the forefront of our advice and, whilst it is often necessary to undertake adjustments in portfolio allocation in order to maintain individual preferences, we are confident that our advised portfolios remain well placed in meeting our clients’ needs. On behalf of all of us here at Ash-Ridge Asset Management, we wish you and your loved ones a healthy, happy and prosperous New Year!

Copyright © Ash-Ridge Asset Management 4th January 2021.

Data Sources: Bloomberg; Brookings Institute; Economic Cycle Research Institute: Financial Sense; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macro Voices; National Bureau of Statistics China; Office for National Statistics; Real Vision; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal; Zero Hedge.

The Market View reflects our in house assessment and views and is posted for client interest only. Please refer to our Terms of Use at the bottom of this page.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has been advising me for over 25 years. I have seen a very significant increase in the value of my portfolios over the years and have been very impressed by their professionalism, attention to detail, hands on management and care. I have been thoroughly pleased with the service so far.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.