Market View - 1st Quarter 2024

“The yield on the US 10-year Treasury note edged higher to 3.86% mark on the final trading day of 2023, remaining relatively close to the five-month low of 3.78% from Wednesday and marking a flat close to a volatile year, as markets continued to gauge the extent of rate cuts that the Federal Reserve may deliver next year. Fed funds futures indicate that 85% of the market has positioned for a rate cut by March, lifting demand for Treasury securities across all durations. The yield on the 10-year note plunged by 1.2% since hitting a 16-year high of 5% in October, underscoring a sharp pivot from the Fed’s earlier rhetoric that interest rates should stay higher for longer. The latest data also supported the late-year bond rally, as PCE inflation slowed and unemployment claims rose more than expected. The consequent support for fixed-income assets drove a surge in bond indices, with several booking their best performances since 1990.” – Trading Economics 30th December 2023

LAST QUARTER REVIEW

The Federal Reserve (Fed) maintained the federal funds rate at a 22-year high of 5.5% for a third consecutive Federal Open Markets Committee (FOMC) meeting in December, while indicating a 0.75% reduction during 2024. GDP growth for 2023 is now expected to have been 2.6% and is forecast to be 1.4% during 2024, while inflation has been revised lower to 2.8% for 2023 and 2.4% is forecast for 2024.

US consumer price inflation annualised, slowed to 3.1% in November 2023, the lowest reading in five months, from 3.2% in October driven primarily by falling energy costs. However, core inflation remained at 4% and the monthly rate rose to 0.3% from 0.2%, in line with forecasts.

US Treasury (UST) yields all along the yield curve fell throughout the last quarter, reflecting the market view that the Fed is done with hiking interest rates, and that 2024 will see the central bank begin cutting rates to try and avert a recession and ease financial pressures within the economy. During the quarter the interest rate for the 2-year Note fell from 5.03% to 4.28%, while the benchmark 10-year Treasury Note yield fell from 4.50% to 3.84%.

Last quarter, the US dollar gave back some of its 2023 gains, as the DXY index (a basket of other currencies) fell from 106.18 to 101.36 and was down 2% during 2023, the first yearly decline since 2020 after gaining about 15% over the previous two years. Despite all the economic indicators suggesting the world’s largest economy will experience some form of recession in 2024, stocks on Wall Street remained firmly under the control of the bulls as the Dow and S&P 500 gained 13.7% and 24.7% respectively during 2023, and the Nasdaq 100 surged 54.7%, fuelled by mega-cap tech stocks and the AI trend.

In the UK, the Bank of England (BOE) held its base rate at 5.25% (a 15 year high) for the third consecutive time during its latest Monetary Policy Meeting (MPC) in December despite signs of a declining economic backdrop and market expectations that rates will be cut in 2024. The latest UK inflation data showed the consumer price index (CPI) fell to 3.9% in November 2023, the lowest since September 2021, from 4.6% in October and well below forecasts of 4.4%.

GDP data for the third quarter showed the British economy declined 0.1% which combined with a revised GDP figure of zero growth in Q2 (previously estimated at +0.2%) suggests the UK is on the verge of recession. The BOE’s insistence however that there will be no interest rate cuts in the first few months of 2024 resulted in sterling rising to $1.28 at the end of 2023, gaining almost 6% for the year.

In the Eurozone, the European Central Bank (ECB) continued its battle to try and curb high inflation by maintaining interest rates at multi-year highs of 4.5% for the second consecutive meeting in December, while economic growth remains stagnant falling 0.1% during Q3 of 2023. The ECB declared full reinvestment under the Pandemic Emergency Purchase Programme (PEPP) scheme will end on June 30 and the portfolio will then fall by €7.5 billion per month until the end of 2024, as it anticipates inflation this year falling to 2.7% from an average of 5.4% during 2023.

At its December fixing, the People’s Bank of China (PBoC) maintained lending rates at record lows in an attempt to revive a struggling economy, dragged down by the property sector as China’s biggest property developers faced large-scale defaults. The one-year loan prime rate (LPR), which is the medium-term lending facility used for corporate and household loans, was held at 3.45% and the five-year rate, a reference for mortgages, was left at 4.2%, while the yuan was down 3.4% during 2023.

The Bank of Japan (BoJ) at its December meeting maintained its key short-term interest rate at -0.1% and that of 10-year bond yields at around 0% as expected by unanimous vote, as the economy shrank 0.7% in Q3, the first GDP contraction since Q3 of 2022, amid elevated cost pressures and mounting global headwinds. The BoJ also left unchanged a loose upper band of 1.0% set for the long-term government bond yield, while annual inflation dropped to 2.8% in November from 3.3% in the prior month, the lowest since July 2022.

Global oil prices fell 10% during 2023 to around $71, the first price decline since 2020 as concerns grew about slowing demand and increasing supplies including in the US, which has hit a record high in crude production, estimated at 13.3 million barrels per day in the last week of December combined with record outputs in Brazil and Guyana. During December, Angola’s surprise exit from OPEC, and vessel attacks by Houthi rebels that disrupted trade in the Red Sea, together with the prospect of a prolonged conflict in Gaza provided oil markets with plenty of food for thought in 2024.

Gold bullion increased more than 13% during 2023 to hit a new all-time high of $2062.78, after registering declines in both 2022 and 2021. Most of the price increase occurred last quarter in the expectation that the Fed will be cutting interest rates in 2024.

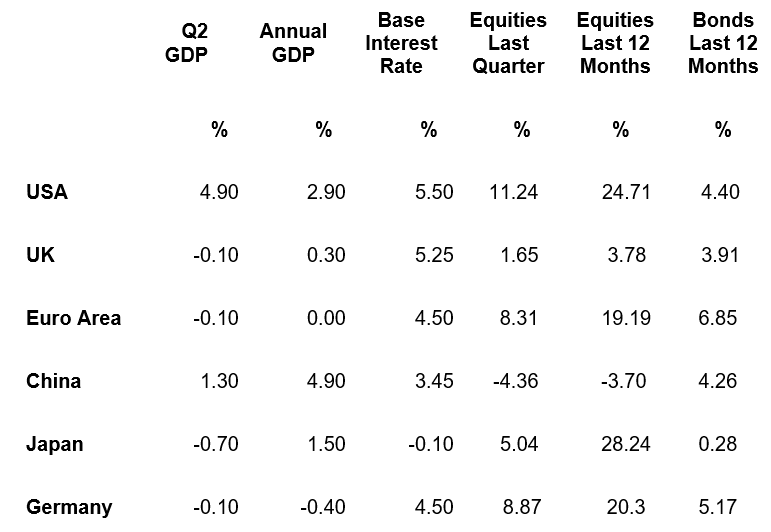

GDP Data shown are to the 30th September 2023; Interest Rate, Equity & Bond Index Data are to the 29th December 2023; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzhen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Sovereign Bond Indices used: S&P US T-Bond, S&P UK Gilt Bond, S&P Eurozone Sovereign Bond (Eur), S&P China Bond, S&P Japan Government Bond, S&P Germany Sovereign Bond.

CURRENT CONSIDERATIONS

Reflecting now at year end upon the positive market data in equities, bonds and currencies suggests that 2023 was a relatively relaxed and smooth year for investors. The reality however is that as the Fed and other major central banks continued to increase interest rates during the first three quarters of the year in their quest to subdue inflation, the past year was anything but a joy ride for investors and their advisers as most major economies with the exception of the US teetered on the brink of recession and the once powerhouse of emerging market growth China continued to struggle for a combination of internal and external reasons.

On top of that, investors had to contend with the continuing conflict in Ukraine as well as the new Middle East war following the atrocities in Israel on the 7th October, although, thankfully, the world’s largest economy continued to defy expectations with remarkable GDP growth despite the Fed taking borrowing costs to their highest in more than two decades at 5.5% for the base rate. Most investors understandably took a cautious approach throughout the year as most reliable historic indicators (including the US Treasury yield curve which has proved infallible since 1957) had been suggesting since the summer of 2022 that the US economy was headed for a recession sometime in either 2023 or early 2024.

The extraordinary stock market returns on Wall Street for 2023 suggest equity investors are either anticipating no recession or at the very worst a soft landing for the US economy with no further major banking failures. If they are wrong, we can expect a severe bear market in global equities while the rewards that bond investors have enjoyed in both the US Treasury market and UK gilt market during the past few months look set to continue further this year regardless of the severity of any US or UK recession as both the Fed and BOE will almost certainly be cutting rates to a greater or lesser extent.

While the interest rate on the benchmark US 10-year Treasury Note has fallen almost 25% in the past few months from more than 5% to less than 3.9%, a similar development has occurred in the UK gilt market as the 10-year Gilt yield has fallen to 3.53% from 4.71% in September. Accordingly, investors appear to be factoring in interest rate cuts of nearer 1.5% from both the Fed and the BOE compared to the much more conservative reduction indicated by the rhetoric from the respective central banks.

The risk remains, however, that the Fed has not necessarily got inflation totally under control yet and may now err in cutting interest rates too soon, just as unfortunately in 2021 and 2022 they failed to nip in the bud the inflationary effects of the post Covid lockdown fiscal and monetary stimulus by beginning to raise interest rates too late! This possibility is evidenced by the incredible resilience in the US GDP numbers which, according to the Atlanta Fed’s real time model, on the 22nd December showed the fourth quarter print projected to be 2.3% which suggests more of a boom than a recessionary soft landing at this stage!

Additionally the underlying concerns about whether inflation has been brought under control by the central bank appeared to have been shared by Wall Street initially last quarter as evidenced by the S&P 500 having experienced its first 10% correction since the market bottom of October 2022, as it closed at 4117.37 on the 27th October. This correction had occurred despite an encouraging earnings season for the more than 250 companies of the S&P 500 index whose results had been announced during October.

The catalyst that appeared to arrest the correction and prevent it potentially becoming a full-blown bear market was the bond market rally that commenced on the 1st November, following the yield on the US 10-year benchmark Note briefly touching 5% a few days earlier. The bond rally was triggered by the market’s reception to Treasury Secretary Janet Yellen’s announcement on the 1st November that the US government would not issue as many notes and bonds as previously intended, but instead issue more bills which have shorter duration, following which both the US bond market and Wall Street have been off to the races.

Accordingly, we must appreciate that Wall Street bulls have since November been driving the equity market to near all-time highs on the back of the collapse in long term Treasury yields. Provided inflation remains under control, and bond yields continue easing, thereby facilitating a soft economic landing, there is every reason to believe that the rally on Wall Street can continue or not necessarily fall too far in 2024.

However, if a more severe and prolonged recession materialises then the equity bear market, that so many respected analysts have been predicting, will come to fruition this year. Additional risks of course include an escalation in the current wars being waged in the Ukraine and Gaza, especially if these were to finally pit the US and the West against Russia, while tensions between America and China is another volatile variable to factor in when determining the optimal asset allocation strategy.

Despite these geopolitical tensions, the US dollar is likely to remain strong in 2024 and retain its role as the global reserve currency despite the enormous total debt position of the US government at $33 trillion. The sheer size of the offshore eurodollar market, at somewhere between $30 and $80 trillion, and the liquidity convenience it affords corporations and businesses of every nation, is the primary reason any geopolitical threat is unlikely to topple the greenback in the foreseeable future.

Another market sector that triggered investor concerns last year was the energy market due to a combination of supply issues that were partly related to the Russia Ukraine conflict and partly to the world’s conviction, rightly or wrongly, that climate change is largely caused by fossil fuels and that green energy is the way forward. This rationale prevails despite reliable data showing that after all the subsidies and investment ($4.6 trillion) in alternative energy over more than two decades, we still rely on fossil fuels for more than 85% of our energy supply.

Oil and gas will continue to play a key role for the foreseeable future and politicians in every nation need to recognise that the transition to clean renewable energy is likely to take decades, and accordingly manage demand and supply issues without giving in to the whims of often ill-informed albeit well-intentioned pressure groups. As an example, global policy goals are targeting net zero carbon emissions by 2050 and suggest we have already made enough progress in this energy transition to begin phasing out fossil fuels.

Alternative data suggests however, that every single wind turbine ever built combined with every single solar farm ever built supplies less than 2% of our global energy needs. By contrast, achieving these stated goals by 2050 with wind and solar alone would require building 50 times as much new wind and solar in the next 25 years as we were able to build in the last 25 years.

Similarly data suggests that the Electric Vehicle revolution will require unprecedented increases in environmentally destructive mining operations needed to supply all the copper, lithium, nickel, cobalt, and manganese required to build all those electric vehicles. Accordingly while there will doubtless be ample investment opportunities in alternative energy ventures this year and in the future, let’s not overlook the enormous investment opportunities that will develop in the oil and gas sector both this year and for many years to come.

FORWARD OUTLOOK

We make no apology for stating once more that equity market bottoms on Wall Street have usually occurred after the Fed has ceased raising interest rates and begun reducing them which now looks almost certain in 2024 and maybe as early as the end of this first quarter. The optimal time to go long on Wall Street has usually been when the Fed has cut rates sufficiently enough to steepen the yield curve, which again is likely to happen during the first half of this year.

A new US Treasury bull market commenced during the last quarter of 2023 and, barring a recurrence of the inflationary pressures that plagued the US and other western economies during 2022 and early 2023, looks set to continue during 2024 as the Fed and other central banks begin reducing interest rates to engineer an economic soft landing. Opportunities in this asset class will also include investment grade corporate bonds provided a banking crisis can be averted during the recession.

In global equities, the stark undervaluation of UK stocks remains with the current price to earnings ratio (PER) of the FTSE 100 at just 9.5 times, compared to 26.35 times for the S&P 500. While the UK market lacks the glamorous tech stocks that drive Wall Street valuations, it is an internationally diverse index with 80% of earnings coming from overseas with its optimal performance periods typically when the dollar is strong versus sterling.

However the most attractive opportunities in the UK equity market during 2024 are likely to occur in the smaller domestic focused stocks that make up the FTSE 250 and FTSE Small cap Indices, as the BOE’s likely interest rate reductions drive their valuation potential. Additionally, investors should benefit from an additional layer of value through typically higher dividend yields with the FTSE 250 yielding 3.69% as at the 29th December 2023.

An investment in the FTSE 250 (which has a combined aggregate valuation of £317 billion) at its inception on October 12th, 1992, would have comfortably outperformed the FTSE 100 (aggregate value £1.9 trillion) return, but with greater volatility and steeper bear markets.

As previously observed, we also envisage both the UK gilt market and high yielding dividend stocks benefitting from the aging UK population as both the government and large corporations look for ways to bolster their pension offerings for employees. Accordingly, if markets play out as we believe likely during 2024, the best opportunities will involve increasing exposure to high quality government and investment grade debt all along the duration curve together with global equities that offer relative value including UK midcap and smaller company stocks.

Maintaining a well-diversified and balanced portfolio remains key while we navigate a potential forthcoming recession. For now, we continue to advise a defensive portfolio allocation with an emphasis towards value and income. Allocation to Fixed Interest will be largely maintained via actively managed Bond and Multi Asset funds with a view to providing additional diversification and the potential to take advantage of future growth opportunities as they present themselves.

As always, investment risk is at the forefront of our advice. Whilst it is often necessary to undertake adjustments in portfolio allocation to meet individual needs and preferences, we are confident that our advised portfolios will continue to remain well placed in meeting our clients’ overall objectives.

From all of us at Ash-Ridge Asset Management, we wish you and your loved ones a Happy, Healthy, and Prosperous 2024!

Copyright © Ash-Ridge Asset Management 1st January 2024.

Data Sources: Bank Of England: Bloomberg; Brookings Institute; Economic Cycle Research Institute; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macro Voices; National Bureau of Statistics China; Office for National Statistics; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal; Zero Hedge.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has been advising me for over 25 years. I have seen a very significant increase in the value of my portfolios over the years and have been very impressed by their professionalism, attention to detail, hands on management and care. I have been thoroughly pleased with the service so far.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.