Market View - 1st Quarter 2025

“The Fed announced another 0.25% cut to the federal funds rate in December 2024, marking the third consecutive reduction this year and bringing borrowing costs to the 4.25% – 4.50% range, in line with expectations. The so-called dot plot indicates that policymakers now anticipate just two rate cuts in 2025, totalling 0.50%, compared to the 1.00% of reductions projected in the previous quarter.” – Source: Trading Economics

LAST QUARTER REVIEW

Global equity markets continued to rally as the Federal Reserve (Fed) reduced interest rates twice by 0.25%, but Wall Street indices would likely have ended 2024 even higher were it not for the Fed’s suggestion that 2025 would now probably see an additional 0.50% interest rate reduction compared to the 1% previously expected. Markets were also buoyed by the conclusive US election results in November that will see Donald Trump return to the White House on the 6th January accompanied by a Republican controlled Senate and House of Representatives.

The market consensus is that Trump’s economic policies will be positive for markets while recognising the proposed import tariffs could negatively impact inflation and result in the Fed having to abandon its interest rate reduction strategy and potentially begin tightening again. The rise in longer term US interest rates reflected these concerns as the yield on the benchmark 10-year Treasury Note which rose from 3.75% rose to 4.58%.

The Fed’s more conservative interest rate proposals for 2025 together with the market’s concerns about the new administration’s anti global economic strategy resulted in the US dollar (DXY) index soaring almost 8% as the DXY index (a basket of other currencies) rose from 100.53 to 108.44. Wall Street equities continued to break new records as the S&P 500 soared through 6000 and the tech heavy Nasdaq 100 index smashed through 22000 mid-December, although by end quarter prices were a lot lower but still up more than 24%, and almost 27% respectively during 2024.

In the UK, the Bank of England (BOE) left the benchmark bank rate steady at 4.75% during its December meeting, in line with market expectations, as CPI inflation, wage growth and some indicators of inflation expectations had risen, adding to the risk of inflation persistence. This followed a 0.25% interest rate reduction by the BOE at its November meeting, and a statement in December that monetary policy will need to continue to remain restrictive for as long as necessary to curtail the risk of renewed inflation threats.

Markets had anticipated a cautionary approach from the BOE at its December meeting as the annual inflation rate in the UK edged up for a second consecutive month to 2.6% in November 2024, the highest in eight months. In response, interest rates at the long end of the UK bond market rose as reflected in the benchmark 10-year gilt yield rising from 4.01% to 4.57%.

UK equities fell as the FTSE 100 (which is made up primarily of globally focused companies with international earnings) declined 0.78% while the domestically focused FTSE 250 mid cap index retreated more than 2%. In currency markets, Sterling declined in value against the US dollar, falling from $1.33 to $1.25, a level it had traded at for most of the first half of 2024.

In the Eurozone, the European Central Bank (ECB) in December cut its key interest rates for the fourth time this year by 0.25% as expected. This move reflects a more favourable inflation outlook and improvements in monetary policy transmission with Inflation expected to be 2.4% in 2024, 2.1% in 2025, and 1.9% in 2026

As anticipated by the market, The People’s Bank of China (PBoC) maintained its key lending rates steady for the second straight month at December fixing, while keeping the one-year loan prime rate (LPR), the benchmark for most corporate and household loans at 3.1%. Meanwhile, the five-year rate, a reference for property mortgages, was unchanged at 3.6%, while Chinese leaders in early December pledged to increase the 2025 budget deficit to 4% of GDP, the highest on record, to spur an economic turnaround and stimulate consumption.

Meanwhile the Bank of Japan (BoJ) maintained its key short-term interest rate at around 0.25% during its final meeting of the year, keeping it at the highest level since 2008 and meeting market consensus. The BoJ said it needs more time to assess certain risks, particularly US economic policies under Donald Trump and next year’s wage outlook, while maintaining its assessment that Japan’s economy is on track for a moderate recovery, despite some areas of weakness.

Global oil prices remained relatively subdued trading in a $10 range between $67 and $77 and ending the quarter at around $71.80, suggesting global demand is struggling to meet the current supply. With the exception of the occasional Middle Eastern conflict exchange, the oil price looks relatively comfortable within this $10 trading range for the foreseeable future.

The 27% increase in the price of gold bullion during 2024 has undoubtedly surprised most investors and analysts alike. With renewed inflation a potential threat in 2025 and the yield on long dated US Treasuries once more on the rise, the outlook for bullion in 2025 looks much less attractive.

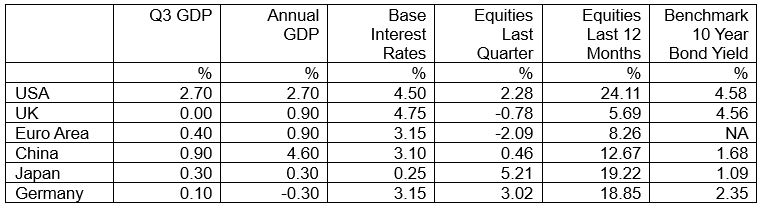

GDP Data shown are to the 30th September 2024; Interest Rate, Equity & Sovereign Benchmark Bond Yield Data are to the 31st December 2024; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzhen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Benchmark Sovereign Bond Yield Data courtesy of Trading Economics.

CURRENT CONSIDERATIONS

2024 will likely be remembered for the continuing rise in the Wall Street stock market, powered by the extraordinary valuations investors are prepared to place upon the Artificial Intelligence (AI) phenomenon that looks set to dwarf the gains of the dotcom boom of the late nineties. The valuations of the largest technology stocks were already racy at the beginning of the year, prior to 2024’s increase of just over 24% in the S&P 500 and almost 27% in the tech heavy Nasdaq 100.

The markets were further buoyed by the Republican clean sweep in the November elections in anticipation of market friendly economic reforms from the new administration and by the Fed’s decision in the second half of the year to finally begin cutting interest rates after the annualised inflation rate had fallen to 2.4% in September. This was the lowest annualised inflation rate since March 2021 when the rate reached 2.6% before peaking in June 2022 at 9.1%, gradually falling thereafter in response to the Fed’s aggressive tightening stance post the Covid lockdowns.

The latest annualised US inflation data at 2.7% for November suggests the battle against rising prices may not be over and the latest Federal Open Market Committee (FOMC) minutes disappointed markets in mid-December with its revised cautious stance on planned interest rate cuts in 2025. Arguably this makes sense when allowing for the potential economic impact of some of the Trump manifesto concerning import tariffs and other inflationary measures.

The performance of Wall Street stocks is all the more remarkable when you consider that the consensus market view 12 months ago was for the S&P 500 to be around 4800 and here we are having recently closed above 6000! On top of that of course the S&P 500 had risen almost 25% during 2023 and so effectively is up almost 50% in just 2 years.

Many renowned and respected market analysts who have been bearish these past couple of years due to several considerations including racy stock valuations are reevaluating their views. Included among these is David Rosenberg who recently suggested we are seeing a model shift in so far as determining market valuations is concerned and that, until the extent of the AI revolution has fully run its course, relying on traditional factors such as the trailing or one-year forward price earnings (PE) multiples may prove unreliable.

Accordingly, as with the nineties tech bubble, it may take years before hindsight reveals just how realistically valued or otherwise Wall Street’s AI driven stocks are at the beginning of 2025. We could be close to a long overdue bear market based on normal valuations, but just as easily, based on the Fed rate cycle, the equity risk premium on a relative basis, the unprecedented purchasing power of the momentum driven index funds, along with the potential for an AI super cycle, we could have a long way to go before the bubble eventually bursts.

While it may be difficult to discern the likely market impact of the incoming Trump administration’s pro-growth, low tax, pro America anti-globalisation economic policies, we might look back historically to see what the impact of similar Republican type agendas had on the market compared to the traditional perception of higher tax, bureaucratically heavy Democratic administrations. In order to get an accurate correlation, we would of course have to examine not only the presidential periods but additionally the balance of power in Congress.

However taking the simplistic analysis of four-year presidential cycles, the corresponding stock market performances going back to the beginning of the eighties might surprise you. Wall Street’s best 4 year run as measured by the S&P 500 returns under a new president since 1980 was during the tenure of Democrat Barak Obama with a 81.4% increase followed by Democrat Bill Clinton’s first four years with a 79.2% rise and current incumbent Democrat Joe Biden with a 59% increase in the market (after 47 months in office) is only narrowly beaten into third place by Republican Donald Trump with a 63.0% market increase in the S&P 500 during his first 4 year tenure.

Republican hero Ronald Reagan who, along with Fed Governor Paul Volcker, is credited with finally killing the hyperinflation of the late seventies during his tenure in the early eighties can only make 6th place with a 38.7% increase in the S&P 500 during his first 4 years. If we look at the presidents who enjoyed two terms, the clear winner since the early 80ies is Democrat Clinton whose combined tenure coincided with a 211.3% increase in the S&P 500 while fellow Democrat Obama is not far behind with 175.9% during his 8 years in charge.

Republican Reagan is a distant third with the S&P 500 rising just 129.6% during his 8 years in office while Republican George W Bush is the clear loser with the benchmark equity index declining 39.5% during his 96 months in office. So much for the myth that stock markets always do best under tax cutting Republican Presidents.

The data clearly shows that it matters little whether the government is coloured red or blue, the more important considerations are the actions of the Fed together with the prevalent economic theme dominating investor decisions. Clinton appears to have been fortunate to be in the White House during the birth and duration of the dotcom era, while Bush Junior was arguably unlucky to be there when the dot com bubble burst and latterly when the subprime banking debacle surfaced.

The performance of the market currently suggests investors believe that over the long term of the next 5 or 10 years, AI is going to be a fundamental game changer as far as what it means for the economy. Effectively investors believe the AI revolution will lead to a lower corporate cost curve which is bullish for profits both now and in the future.

The market is of course additionally excited about the Trump victory which, when combined with Republican majorities in the House and Senate, has given the political right a clean sweep. The market perceives as positive the economic impact of Trump’s proposed corporate tax cuts and the realisation that for the next 2 years at least (when the next Congressional elections are due), the US is going to be run by a business-friendly administration.

Investors however will be hoping that Trump’s proposals to levy import tariffs of 20% as standard and 60% on China turn out to be mostly rhetorical as trade wars are not usually conducive to rising markets. The rising yields in the US Treasury market, especially at the longer end confirm the nervousness of the market as far as inflation and the potential negative impact of Trumps’ import tariff proposals are concerned and suggest that Fed chair Jay Powell is probably right to be cautious about future interest rate cuts while the spectre of recurring inflation remains on the horizon.

FORWARD OUTLOOK

It will be interesting to see what impact the proposals from the incoming Trump administration will have on prices in the oil market. The reality throughout 2024 is that despite supply cutbacks necessitated by a combination of lack of profit margin and pressures from the climate change fraternity, the price of crude oil rarely rose above the $70 – $80 trading range it has operated in over the past 2 or 3 years.

The rare occasions when the price spiked higher has usually been as a result of increased geopolitical tensions in the Middle East, which suggests that global demand is not as strong as the economic data might suggest. History has shown that the demand for oil is a reliable economic indicator and suggests the overall macroeconomic landscape remains uncertain for investors.

The insistence of the green energy sector that the global economy can survive, let alone thrive, without fossil fuels adds to the complexity of analysis. The fact remains that trying to evaluate the true cost of renewable energy compared to fossil fuels is nigh on impossible and arguably futile, since wind and solar on average are only able to operate for 25% of the time, compared to oil-based electricity which is available 24/7.

Additionally with the AI revolution in full swing the gargantuan demand requirements of this exciting new sector could transform the energy market in the US and to satisfy this, renewables are not even in the equation since these power-hungry new technologies cannot afford the downtime necessary for variable energy sources like wind and solar. According to respected oil analyst Art Berman, comparing the options of wind and solar with fossil fuels is analogous to comparing a bicycle and a motor car.

A bike is cheaper but it’s useless for long journeys or heavy loads. A car costs more but gets the job done and discerning oil consumers and investors alike will recognise energy works exactly the same way.

We shall be watching closely the price of oil in 2025 to give us an indication of both how robust the underlying global economy is, and to gauge the true potential of the AI driven market bubble. Analysing the last century’s worth of data in relation to current market valuations suggests the market expects corporate profits on the back of the AI infused super cycle of roughly 17% per annum growth for the next 5 years, which would be double the historical norm of the average five-year period of just 8% pa.

Confirmation of this expectation of future profit growth comes in form of R&D spending in the US surging and representing the strongest component of the economy. Analysts are no longer talking about the importance of the consumer to the US market but instead corporate R&D spending which has been a major contributor to the GDP numbers that we’ve seen throughout 2024.

Accordingly investors who agree with this market prognosis for the next five years are comfortable being fully invested in equities. However inevitably there are huge downside risks if the bulls are wrong, with several analysts aghast to observe everybody seems fully invested with portfolio managers in domestic equities running cash ratios of just over 1%.

Further confirmation of how heavily the bets are skewed towards equities can be observed in the household balance sheet in the US, where 70% of the asset mix is in equities. Data shows that even amongst baby boomers over the age of 65, 60% of their mix is in equities, when historical valuation norms suggest it should be closer to 30% to 40%.

In the UK, investors during 2024 saw some reward for their patience with encouraging returns from both large international stocks and smaller domestic focused on. We expect undervalued stocks to continue to reward investors in 2025 with the FTSE 100 benefitting additionally when the US dollar is strong.

As always, maintaining a well-diversified and balanced portfolio remains key while we navigate a potential forthcoming recession. For now, we continue to advise a defensive portfolio allocation with an emphasis towards value and income. Allocation to Fixed Interest will be largely maintained via actively managed Bond and Multi Asset funds with a view to providing additional diversification and along with the potential to benefit from future growth opportunities as they present themselves.

As always, investment risk is at the forefront of our advice. Whilst it is often necessary to undertake adjustments in portfolio allocation to meet individual needs and preferences, we are confident that our advised portfolios will continue to remain well placed in meeting our clients’ overall objectives.

Finally, all of us at Ash-Ridge Asset Management would like to wish you and your loved ones a Happy, Healthy and Prosperous 2025!

Copyright © Ash-Ridge Asset Management 1st January 2025.

Data Sources: Art Berman: Bank Of England: Bloomberg; Brookings Institute; Economic Cycle Research Institute; European Central Bank; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macrotrends: Macro Voices; National Bureau of Statistics China; Office for National Statistics; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.