Market View - 1st Quarter 2026

“The Federal Reserve cut the federal funds rate by 0.25% to a range of 3.5%–3.75% in its December 2025 meeting, following similar reductions in September and October, and in line with expectations. This brings borrowing costs to their lowest level since 2022. Policymakers left their projections for the federal funds rate unchanged from September, signalling only one 0.25% cut in 2026.” Source Trading Economics

LAST QUARTER REVIEW

Global equity markets enjoyed strong growth as the US tech stocks that have either developed Artificial Intelligence models or are using AI to power growth in their own sectors, are all doing well. The major Wall Street indices of the S&P 500, Dow Jones 30 and Nasdaq 100 recorded successive all-time highs throughout the quarter, and closed 2025 just shy of those highs

At its December meeting of the Federal Open Markets Committee (FOMC), the Fed revised upwards its GDP growth forecast with 2025 now expected at 1.7% (1.6% previously) 2026 to 2.3% (from 1.8%), and 2027 at 1.9% (from 1.8%). PCE inflation is now expected to be slightly lower this year at 2.9% (vs 3.0%) and next year at 2.4% (vs 2.6%). Forecasts for the unemployment rate were left unchanged at 4.5% for 2025 and 4.4% for 2026.

At the December FOMC press conference, Fed Chair Jerome Powell reiterated ongoing concerns regarding inflation – bond markets however remained relatively calm seeing deflation as the bigger threat. The yield on the benchmark 10-year US Treasury Note was barely changed at 4.15% from 4.16% end September, while the interest rate payable on 4-week Bills dropped to 3.61% (4.22%), as the yield curve continues to un-invert.

The US dollar was relatively stable when measured against the DXY, a basket of other currencies weighted on market size. During the quarter, the greenback traded within a range of $96.5 to $100.5 and ended the period broadly where it began at $98.46.

In the UK, the Labour government’s November budget was greeted with mixed reactions economically. The government’s tax take is projected to reach an all-time high of 38% of GDP in tax year 2030-31, and growth forecasts have been downgraded between now and then.

At its December meeting, the Bank of England (BoE) cut the Bank Rate by 0.25% to 3.75%, its lowest level since 2022, as easing inflation and growing signs of economic strain prompted policymakers to act. The move marked the first rate cut since August. Five policymakers voted for the cut while four favoured holding rates, a less dovish-than-expected split that prompted traders to scale back expectations for further BoE rate cuts.

UK inflation stood at 3.2% in November, the lowest in 8 months and below the BoE’s forecast, while GDP contracted for a second month in October, and private-sector wage growth continued to cool. Despite the mixed domestic economic outlook and the concerns of many analysts about the budget’s implications, the FTSE 100 (made up primarily of globally focused companies with international earnings) rose more than 6.0% last quarter and was up more than 21% during 2025, while the domestically focused FTSE 250 mid cap and FTSE SmallCap indices rose 8.96% and 10.14% respectively last year.

In currency markets, sterling remained strong against the dollar at $1.34, little changed over the quarter. The UK bond markets were also little changed with the yield on the benchmark UK 10-year gilt easing to 4.48% at (4.70% end September).

In the Eurozone, the European Central Bank (ECB) kept its key interest rates unchanged for the fourth consecutive meeting in December, with the deposit facility at 2.00%, and the main refinancing rate at 2.15%. The central bank has revised growth projections to 1.4% in 2025, 1.2% in 2026 and 1.4% in 2027 and 2028, while inflation is expected to average 2.1% in 2025, 1.9% in 2026, 1.8% in 2027 and 2% in 2028.

The People’s Bank of China (PBOC) kept key lending rates at record lows for a seventh consecutive month in December, in line with market expectations, with the one-year Loan Prime Rate (LPR), the benchmark for most corporate and household borrowing at 3.0%, while the five-year LPR, which anchors mortgage rates, held at 3.5%. The decision came after data showed retail sales and industrial output growth in November eased amid lingering property sector crises, and continued weakness in credit demand

The Bank of Japan (BoJ) unanimously raised its key short-term interest rate by another 0.25% to 0.75% at its December meeting, marking the highest level since September 1995. The BoJ said it expects companies to continue delivering steady wage increases in 2026, amid improving corporate profits, and projected that core consumer price inflation will slow to below its 2% annual target through the first half of 2026, before gradually picking up thereafter.

The crude oil price continued to trend down throughout the quarter despite geopolitical support and solid US economic data, with the price of West Texas Intermediate (WTI) recording its steepest annual drop since 2020, as it ended the year at $57.41 down from almost $72 a year ago. Most major traders expect a global oil surplus next year due to rising production inside and outside OPEC+.

Gold bullion meanwhile continued its phenomenal bull market run, closing the year at $4,318 from just over $2,600 twelve months ago representing an annual rise of almost 65%. The price of physical silver rose more than 53% during the last quarter and almost 148% during 2025 to close at $71.

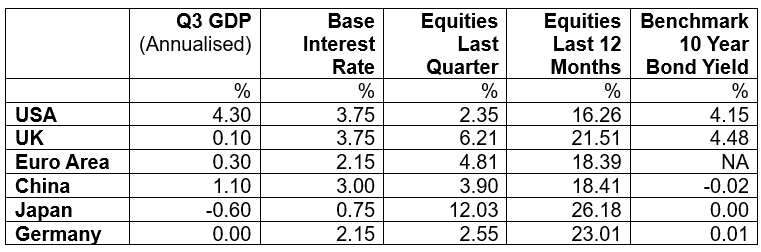

GDP Data shown are to the 30th of September 2025; Interest Rate, Equity & Sovereign Benchmark Bond Yield Data are to the 31st of December 2025; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzhen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Benchmark Sovereign Bond Yield Data courtesy of Trading Economics.

CURRENT CONSIDERATIONS

As we begin the new year, investors will once more be reflecting on another extraordinary year for the equity allocation of their portfolios. This will be largely thanks to the highly valued US large cap market and especially the seven stocks that dominate the S&P 500 and Nasdaq 100.

The seven stocks are Nvidia (now valued at $4.35 trillion, and up 34.96% during 2025), Apple ($4.1 trillion, 11.48%) Microsoft ($4.03 trillion, 15.57%), Alphabet $3.62 trillion, 65.32%), Amazon ($2.34 trillion, 4.81%) Meta ($1.90 trillion, 10.15%), and Broadcom ($1.64 trillion, 49.22%). These stocks, often referred to as the Magnificent Seven, have a combined market capitalisation of $22 trillion, representing almost 35% of the S&P 500.

All these stocks have benefited directly or indirectly from the incredible premium investors are willing to stake on the AI phenomenon, both in the short and long term. Sceptics warn that we could be headed for a repeat of the dotcom bubble collapse seen at the turn of the century – for now, however, the consensus is that there are plenty of unrealised gains to be made despite the unprecedented valuations.

Investors must remember global equity markets, and especially American companies traded on Wall Street, are heavily influenced by algorithmic indexation purchasing. Research from pioneer indexation researchers, such as hedge fund manager Mike Green, suggest that as much as 90% of new trades on Wall Street are from exchange traded funds (ETFs) and other indexation vehicles.

These algorithmic trades have no value discernment but instead make their purchases based on the underlying index’s capitalisation. Accordingly, the larger components of an index end up getting bigger simply because an index fund buys more of them each time than they do the smaller index constituents even though the latter often represent better value from a fundamental perspective.

The increasing influence of index funds in modern equity markets has led many analysts like Mike Green to conclude that the Efficient Market Hypothesis (EMH), commonly accepted to be the norm by both market academics and practitioners for more than half a century, no longer exists.

Academic research emerging over the past decade, starting with Ralph Koijen and extending to his work with Xavier Gabaix, suggest the impact of indexation results in the creation of about $7 to $8 worth of market cap for every dollar that flows into the markets, and that the EMH is inaccurate by about 800 to 1. Additional research on this topic has been done by Valentin Haddad at UCLA, who has also teamed up with Mike Green to analyse the market cap impact of this phenomenon.

Mike suggests that the best way to explain this is through the concept of substitution effects and its application or non-application – if an investor is buying the S&P500, it matters not whether they buy United Airlines or American Airlines as they are both 0.002% of the index and will have no meaningful impact on performance.

The investor can buy either stock or could just as easily buy two times as much of the market capitalisation of one, while neglecting the other to mirror the S&P 500 index, or indeed both could be omitted as they are so small. However, the investor cannot do that with Apple, NVIDIA, or Microsoft, but will have to buy these at whatever price they’re offered to have an investment that accurately reflects the S&P 500.

As a result, those large stocks have much lower elasticity, or higher inelasticity, than the smaller stocks do. The impact of this is to increase that multiplier over time, as we get a more concentrated index, which, in and of itself is a byproduct of this effect. So indexing is driving concentration, and concentration is driving inelasticity.

Mike concludes that, “inelasticity means that if money is coming in, prices will react more favourably. What looks like a booming economy in the stock market is just a stagnant labour force.”

Mike and Valentin’s research is showing that for many of the largest stocks, e.g. NVIDIA, Apple, etc., inelasticity is an order of magnitude higher than investors could have possibly imagined just a little time ago. Their research is suggesting an incredible market capitalisation creation of between $75 and $100 for each dollar that flows into the market.

For more than a decade, Mike Green’s research on the effects of indexation had been suggesting these unintended consequences which is now being confirmed by other academic analysis. Most importantly, Mike’s work suggests that if people have jobs and their retirement plan investments (via 401K’s etc) are positive, and that these actions are being supported through legislative policy choices such as Secure Act 1 and Secure Act 2 (that have increased participation and increased employer contributions), the market’s positive momentum is likely to continue.

This is of course good news for investors – the flipside, however, is that the market has long since ceased to evaluate rationale value (i.e. EMH is dead) and is simply reflecting investment flows. This is why most comprehensive research suggests that the momentum trades from index funds will, in most circumstances, continue to propel equity indices higher, resulting in the most expensive stocks continuing indefinitely to become even more expensive.

The exception is where human override is applied with the potential to reverse momentum trades – the question, as always, is what sort of economic event could possibly result in such an override – whilst it is impossible to identify and isolate every market risk, it is important to remain vigilant.

Ironically, just as AI has driven the extraordinary gains seen on Wall Street since 2021, the exhaustive research on indexation and momentum trades suggests the biggest market risk is also the advent of artificial intelligence.

AI threatens to make the need for human participation in almost every profession and productive role redundant! Mike Green in a recent research article observed “we basically have businesses in a holding pattern where they’re starting the process of thinking about firing people.”

Mike uses the example of Facebook, who recently introduced performance metrics, with the objective of being to move to a GE type model where they lay off the bottom 10% of performers on a continual upgrading basis. He believes developments like this are telling us that the uncertainty concerning the impact of AI on the security of employment is likely to morph into some form of increased unemployment.

This is likely to be gradual at first, but then almost without warning we could be faced with a scenario in which unemployment begins to rise significantly. When that happens, positive investment flows into markets could slow and then eventually reverse if the impact of AI on the jobs market will be as radical as some commentators are suggesting.

Investors are of course accustomed to thinking of equity markets as discounting mechanisms, and accordingly, it is natural to think the economic future must be good, because the market is rising and therefore discounting something positive in the future. Mike cautions against that traditional mindset, and explains, “I just don’t think that’s true, and instead it really reflects the fact that companies have not yet laid off the employees despite the fact that we’re seeing significant weakness in demand.”

It is reassuring to know the American government has created a seemingly perpetual flow of stock market money through the Qualified Default Investment Alternatives (QDIA). All workers are automatically enrolled into this 401K, which offers 10 basic choices of investments, all of which are various forms of Vanguard (who pioneered indexation investing in 1976) target date funds.

Mike Green’s final assessment of the impact of AI and indexation suggests investors should be ultra cautious as he explains, “if I’m correct in my analysis of the ultimate impact of AI, companies will try to lay people off as the demand does not expand enough to offset the improvement in productivity. That will ultimately prove to be negative for equity prices as those flows potentially begin to reverse as baby boomers head into retirement.

“That’s finally here, and as fewer people have high value jobs that are creating or driving, effectively, an increase in contribution to financial assets, you could see that reverse itself quite sharply. I do not think that is priced into markets currently, and it is a key risk that I’ve been emphasizing, and unfortunately, I think the uncertainty that’s being created right now could very well prove to be that straw that breaks the camel’s back.”

FORWARD OUTLOOK

The US economy which stalled in the first quarter of 2025 due to the uncertainty surrounding tariffs is now firmly back in growth mode with a strong annualised 4.30% growth in GDP achieved in the third quarter. The latest forecast from the Atlanta Fed’s GDP Now model on the 23rd of December is for an annualised 3.0% GDP return for the fourth quarter.

For now, we see no reason to change our cautiously positive views on both the US dollar (which benefits from the enormous offshore eurodollar market), and the US equity market which remains without peer in terms of the potential future technology gains from AI. However, we would reiterate that caution is the watchword considering increasing numbers of academic analysts echoing Mike Green’s long held view that the EMH no longer applies and that market valuations on Wall Street and increasingly globally reflect market flows and not fundamental rationale evaluation.

We remain cautiously positive on US Treasuries due to the potential gains that should materialise due to the yield steepener bull market. The bond market yield curve is signalling yields will fall all the way along the duration curve but more sharply at the shorter end as the un-inversion progresses.

While remain cautiously confident about UK equities and especially the large cap FTSE 100 stocks that comprise globally diversified businesses benefitting from US dollar exposure, we continue to have reservations about UK bonds and sterling for reasons covered in our last Market View. We have, however, been somewhat encouraged by the Chancellor’s budget which was more balanced than we had been led to expect and which, for now, has served to calm currency and bond market nerves.

When opportune, we will seek to increase direct exposure to bonds with a view to taking advantage of the US Treasury yield curve un-inversion and the relative duration value that this should offer. For the present however, we will maintain allocation to Fixed Interest via actively managed Bond and Multi Asset funds with a view to providing additional diversity within this sector.

Maintaining a well-diversified and balanced portfolio remains key while we consider the possibility of a US recession in the year ahead. For now, we continue to advise a defensive portfolio allocation with an emphasis towards value and income.

As always, investment risk is at the forefront of our advice. Whilst it is often necessary to undertake adjustments in portfolio allocation to meet individual needs and preferences, we are confident that our advised portfolios will continue to remain well placed in meeting our clients’ overall objectives.

Finally, all of us at Ash-Ridge Asset Management would like to wish you and your loved ones a Happy, Healthy and Prosperous 2026!

Copyright © Ash-Ridge Asset Management 1st January 2026.

Data Sources: Art Berman: Bank Of England: Bloomberg; Brookings Institute; Columbia Threadneedle Investments; Economic Cycle Research Institute; eurodollar.UNIVERSITY; European Central Bank; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macrotrends: Macro Voices; National Bureau of Statistics China; Office for National Statistics; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.