Market View - 2nd Quarter 2024

“We made a lot of headway toward our inflation goal in 2023, and the labor market moved substantially into better balance, all while holding the unemployment rate below 4 percent for nearly two years. But the data we have received so far this year has made me uncertain about the speed of continued progress. Back in February, I noted that data on fourth quarter gross domestic product (GDP) as well as January data on job growth and inflation came in hotter than expected. I concluded then that we needed time to verify that the progress on inflation we saw in the second half of 2023 would continue, which meant there was no rush to begin cutting interest rates to normalize the stance of monetary policy. Over the past month, additional economic data has reinforced this view.” Excerpts from a speech titled “There is still no rush” given by Fed Governor Christopher J Waller at The Economic Club of New York, New York, New York on the 27th March.

LAST QUARTER REVIEW

At its March Federal Open Market Committee meeting, the Federal Reserve left the Fed funds rate steady at a 23-year high of 5.25%-5.5% for a fifth consecutive meeting. Policymakers still plan to cut interest rates three times this year, and three cuts forecast for 2025, with three more reductions in 2026.

According to the Fed, US GDP growth is expected to be higher than previously forecast in 2024 at 2.1%, and in 2025 at 2% and also in 2026 at 2%. Meanwhile PCE inflation forecasts remain unchanged for 2024 at 2.4% but have been raised to 2.2% for 2025. The unemployment rate is seen lower at 4% in 2024 but projections have remained at 4.1% for 2025.

After falling during the last quarter of 2023, US Treasury (UST) yields rose once more across all durations during the first quarter of this year as the market digested the realisation that the US economy is stronger than previously believed. During the quarter the interest rate for the 2-year Note rose from 4.33% to 4.59%, while the benchmark 10-year Treasury Note yield rose from 3.84% to 4.20%.

The US dollar strengthened as the currency market reflected the expectation that higher interest rates would remain in the US market for now and the DXY index (a basket of other currencies) rose from 101.36 to 104.57 underpinned by bets that other major central banks could start cutting interest rates earlier than the Fed. The realisation that the US may avert a recession in 2024 resulted in Wall Street recording its best start to a year since 2019 as the benchmark S&P 500 rose 10.16% and the tech heavy Nasdaq 100 advanced 8.49%.

During its meeting in March, the Bank of England (BOE) maintained interest rates at 5.25%, with BOE official Jonathan Haskel stating that rate cuts should be “a long way off,” while his colleague Catherine Mann cautioned against excessive expectations for interest rate cuts this year, indicating that it is improbable that the UK will act before the Fed. Interest rates in the gilt market increased during the quarter with the yield on the benchmark 10-year gilt rising from 3.56% to 3.98%.

GDP data for the fourth quarter of 2023 showed the British economy declined 0.3% which followed a 0.1% decline in the third quarter, confirming the UK is in recession. Sterling declined slightly from $1.28 to $1.26 primarily as result of the strength of the American economy relative to the UK’s.

In the Eurozone, the European Central Bank (ECB) maintained interest rates at a 22-year high of 4.5% during its meeting in March, while economic growth stagnated during the first quarter after falling 0.1% during Q3 of 2023. Persistently high inflation (currently at 2.6%), record borrowing costs, and weak external demand continue to exert downward pressure on economic growth.

At its March fixing, the People’s Bank of China (PBoC) maintained lending rates at record lows as the Chinese economy seeks to counter the struggling property sector and a near record low in consumer confidence. The offshore yuan weakened past $7.25, falling to its lowest levels in four months on bets that China will ease policy further to prop up the economy, while the yuan also came under pressure amid growing expectations that US interest rates could remain higher for longer prompting traders to anticipate safe haven status from the dollar.

At its March meeting, the Bank of Japan (BoJ) raised its key short-term interest rate to 0.1% from -0.1%, following eight years of negative interest rates, marking the first interest rate hike since 2007 following inflation exceeding 2% and the largest companies in the country agreeing to raise salaries by 5.28%, the biggest wage hike in over three decades. The yen fell during the first quarter to around 151.5 to the dollar, hovering near its lowest levels in four months on expectations that the Fed’s monetary policy could remain restrictive even as other major central banks start cutting interest rates.

Global oil prices rose 16% during the first quarter to $83, due to a combination of efforts by the OPEC Plus alliance to curb supply, and concerns of persistent geopolitical risks in Eastern Europe and the Middle East. Oil prices were also boosted by Ukrainian drone attacks on Russian refineries which affected more than 10% of the country’s oil processing capacity, while Houthi attacks on Red Sea shipping have been disrupting supply routes.

Gold bullion increased more than 8% during the first quarter, hitting new record highs as heightened geopolitical tensions boosted safe-haven demand for the metal.

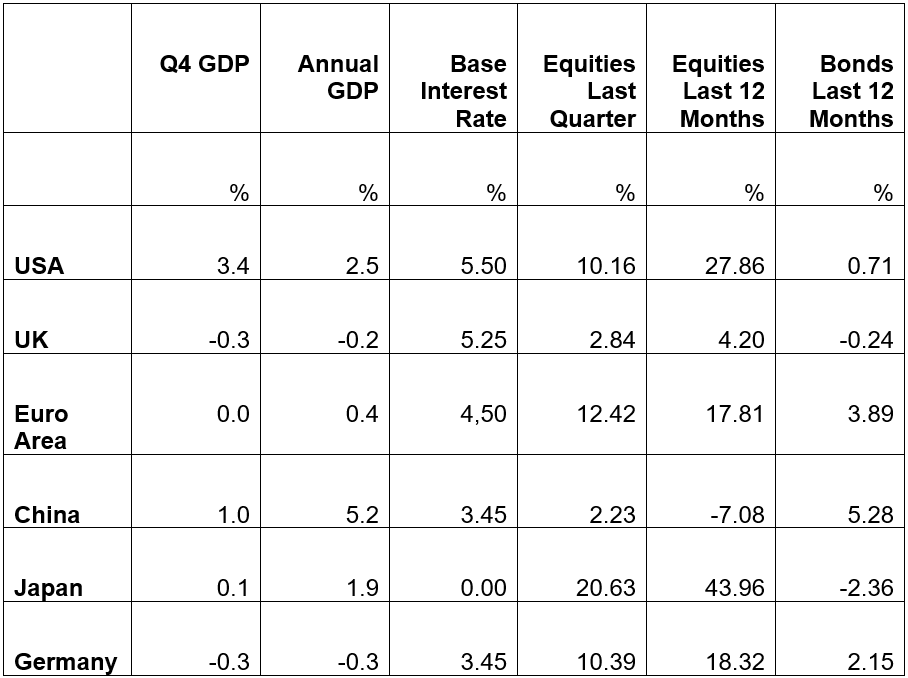

GDP Data shown are to the 31st December 2023; Interest Rate, Equity & Bond Index Data are to the 31st March 2024; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzhen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Sovereign Bond Indices used: S&P US T-Bond, S&P UK Gilt Bond, S&P Eurozone Sovereign Bond (Eur), S&P China Bond, S&P Japan Government Bond, S&P Germany Sovereign Bond.

CURRENT CONSIDERATIONS

The extraordinary Wall Street stock market returns of 2023 continued as the market brushed aside the disappointment that the Fed won’t be cutting interest rates just yet with the realisation that the continued strength in the US economy means there may not be any recession in 2024 after all. The previously infallible signal of an inevitable recession within two years of the US Treasury yield curve inverting in the spring of 2022, appears to have been a false signal with the American economy continuing to grow at an extraordinary pace forcing the Fed to reassess the risk of cutting interest rates too soon.

The US economy grew at a staggering 3.4% in the last quarter of 2023 while the UK, Europe and most of the western economies are already in recession. The exceptions are Japan which grew just 0.1% and China which expanded by 1%.

According to the Atlanta Fed’s GDP Now real time model, on the 27th March the US economy looked set to grow a further 2.1% during the first quarter of 2024. Little wonder the US dollar has been so strong despite the unprecedented and growing US national, corporate and private debt while interest rates all along the US treasury yield curve have risen again after falling quite markedly towards the end of 2023 in anticipation of the Fed rate cuts.

At the end of the last quarter the yield on the benchmark 10-year US Treasury (UST) Note was at 4.2% up from just 3.87% at the end of 2023, while the interest rate on the 2-year UST Note was 4.63% up from 4.23% at the end of 2023. However the UST yield curve remains inverted as does the curve for the eurodollar futures market suggesting the US economy is not of the woods just yet.

The Fed’s dilemma as to how to manage monetary policy this year was made all too clear in a speech given by FOMC board member Chris Waller in New York just before the end of last quarter. He observed that, while economic growth had slowed during the first quarter of this year to 2.1% as projected by the Atlanta Fed’s model from last year’s second half year average of 4%, most indicators including the recent uptick in the inflation data suggest the American economy is running hot!

Fed Governor Waller explained how interpreting the labour market data was proving challenging especially when assessing how supply and demand are evolving. A key observation of the speech is that recent data suggest productivity in the US labour market may once more be approaching levels not seen for two decades or more which if proved correct would be an exceptionally positive sign both for the US and global economy.

The governor observed that when productivity across the economy grows quickly, it means that output and income can also grow quickly without putting upward pressure on inflation and so supporting rising living standards. This of course is a scenario central bankers and policymakers can usually only dream about and has not been consistently observed in the US since the six-year period spanning 1998 to 2004.

Governor Waller explained how over the final three quarters of 2023, productivity grew at a pace of just under 4 percent, much faster than the average since the 1970s, and is happy to entertain the view that the US could be at the start of another era of fast and sustained productivity growth, last seen two decades ago. He does, however, retain a healthy degree of scepticism for now, in the event the recent productivity spurt proves short-lived and unsustainable.

He cites a number of reasons for his caution including the recent increase in inflation data which has turned up for the past 2 months after trending down steadily throughout most of 2023. Governor Waller hopes this could just be an uneven bump in a continuing downtrend, while reiterating that the plan is still to make three rate cuts during 2024, albeit a little later in the year than the market had previously hoped for.

The risk is that if the Fed waits too long before starting to cut rates while the productivity growth of the last year stalls, the banking credit bubbles that currently appear manageable in commercial mortgages and multi-family residential apartment mortgages which when combined have increased by more than $1 trillion in just a short time to more than $6 trillion in total, could quickly trigger a full-blown banking crisis. Were this to happen, this would inevitably destroy the Fed’s credibility with markets and the perception they have the monetary situation under control.

Arguably the crux of the problem when it comes to fiscal and monetary policy is that generations of US policymakers have embraced a statement made by renowned American economist Milton Friedman back in February 1981, namely “government can and sometimes do contribute to inflation. However, the relationship between deficits and inflation is far looser than is widely believed. Moreover, the major harm that deficits do is to foster irresponsible spending.”

Unfortunately, Milton’s Friedman economic analysis has been gladly accepted and taken advantage of (while ignoring his warnings about the risks) by successive administrations since 1981. The current administration has, however, succeeded in taking it to another level, as the US budget deficit now stands at a staggering $34.6 trillion or 123% of GDP. In 2023 alone the US Treasury has to absorb $3.4 trillion in new debt issuance which incredibly the investment market took in its stride!

Almost every year this century, respected economists have been saying that the US budget deficit which stood at just 58.54% of GDP at the turn of the millennium, will result in the American economy becoming a banana republic with soaring inflation, soaring interest rates and a collapsing dollar. However these analysts forget that when your currency is the reserve money of the world and the offshore eurodollar market dwarfs the domestic US dollar market (with some suggesting it to be worth $80 trillion), the limit to irresponsible American government spending before the system breaks is much higher than most analysts can imagine.

Similarly the insatiable appetite for the safe haven investment of US Treasuries is vastly underestimated. For now as has been the case for several decades, USTs remain the ultimate safe haven in a volatile world threatened by endless geopolitical tensions, broken supply chains due to conflicts in Ukraine and the Middle East, climate change worries, etc.

While American policymakers should recognise the time may come when global investors shun both the dollar and the UST market due to their reckless irresponsibility, it does not appear to be on the horizon just yet. Of greater immediate concern is the concentration of market capitalisation and relative overvaluation of tech and Artificial Intelligence (AI) stocks, especially Alphabet (Google) Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla, (“the magnificent seven”).

These stocks which have each outperformed the S&P 500 by more than 100% in the past decade, have lofty valuations based on fundamental metrics such as forward earnings multiples and price-to-sales ratios. However their exposure to growth technologies such as high-end software and hardware, cloud computing and AI arguably position them to continue outperforming, not least because exchange traded and other index funds now play such a big role in determining the popularity of stocks traded on Wall Street.

This is the primary reason why the shares of reasonably valued companies struggle to see their potential realised, as the blind process of indexed funds ignore valuations and sentiment, and simply purchase the basket of stocks in the percentages in which they sit in their respective indices, which inevitably leads to the relative value differentials progressively increasing over time in favour of the overvalued. The inherent inefficiencies indexation brings to markets is frustrating for active investors who have identified relative value in stocks that now remain undervalued for much longer periods than was previously the case.

FORWARD OUTLOOK

The proliferation of index funds that now dominate Wall Street and global equity markets has resulted in increasing market inefficiencies as traditional alpha generating value and growth dynamics become secondary to beta driven by popularity. However this has a risky downside for investors as the computer driven allocations lead to increasingly unrealistic valuations and the potential for exaggerated losses in a prolonged bear market.

In the same scenario, active investors eventually should see their diligence and informed analysis bear fruit with value stocks which are often higher yielding, outperforming or at least falling less in relative terms. Accordingly, until a US recession has materialised or alternatively it becomes clear that steady economic growth will continue, caution will be our watchword with respect to global stocks.

The stark undervaluation of UK stocks remains as previously observed with the price to earnings ratio (PER) of the FTSE 100 at just 10.4 times at beginning of 2024, compared to 26.1 times for the S&P 500, suggesting opportunity when the time is right. The FTSE 100 derives 80% of its earnings from overseas with its optimal performance periods typically when the dollar is strong versus sterling.

As the UK is now officially in recession the likelihood is that, contrary to official statements from the BOE, UK interest rates may well be cut before those in the US whose economy remains hot, and therefore the UK large cap market should benefit from dollar strength versus sterling. Later in the interest rate cutting cycle, we would expect attractive opportunities in the smaller domestic focused stocks that make up the FTSE 250 and FTSE Small cap Indices, and that should benefit also from the higher dividend yields available with the FTSE 250 yielding 3.4% at quarter end.

In fixed income markets, UST yields have risen largely as a result of investors adjusting to the fact that the Fed is likely to begin cutting interest rates later in 2024 and fewer times than previously believed at the beginning of the year. We remain convinced that a new US Treasury bull market commenced in late 2023 and is set to continue during 2024. We will, however, continue to exercise caution for now, just in case the excessive liabilities that US and global banks have in commercial real estate and multi-family apartment block residential property gets out of hand and results in a major banking crisis.

Maintaining a well-diversified and balanced portfolio remains key while we navigate a potential forthcoming recession. For now, we continue to advise a defensive portfolio allocation with an emphasis towards value and income. Allocation to Fixed Interest will be largely maintained via actively managed Bond and Multi Asset funds with a view to providing additional diversification and the potential to take advantage of future growth opportunities as they present themselves.

As always, investment risk is at the forefront of our advice. Whilst it is often necessary to undertake adjustments in portfolio allocation to meet individual needs and preferences, we are confident that our advised portfolios will continue to remain well placed in meeting our clients’ overall objectives.

Copyright © Ash-Ridge Asset Management 1st April 2024.

Data Sources: Bank Of England: Bloomberg; Brookings Institute; Economic Cycle Research Institute; European Central Bank; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macro Voices; National Bureau of Statistics China; Office for National Statistics; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has been advising me for over 25 years. I have seen a very significant increase in the value of my portfolios over the years and have been very impressed by their professionalism, attention to detail, hands on management and care. I have been thoroughly pleased with the service so far.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.