Market View - 2nd Quarter 2025

“US stock selloff intensified in late Friday trading after Fed Chair Jerome Powell warned that the economic fallout from the escalating trade war could be worse than expected. The S&P 500 fell 5.7%, the Dow plunged 2,000 points, and the Nasdaq lost 5.6%, hitting their lowest levels since last May and extending the prior session’s losses. Powell cited rising risks of inflation and slower growth, while reaffirming a cautious, wait-and-see stance on rate cuts. Market anxiety grew after China’s finance minister announced a 34% tariff on all U.S. imports, mirroring President Trump’s move on Wednesday. Economists warned of higher prices, weaker growth, and a potential recession, despite stronger-than-expected payroll data..” – Source: Trading Economics 4th April

Last Quarter Review

Global equity markets were thrown into confusion by the uncertain eventual consequences on global trade and economic growth by the Trump tariffs. Wall Street indices in particular struggled and showed sizeable losses for the quarter but the excessive returns made in the previous couple of years on the expectation of the rapid growth of markets both directly and indirectly connected to artificial intelligence mean long term investors can relax for now.

The market’s initial tariff concerns about inflation intensified as the University of Michigan’s final consumer sentiment reading for March showed the highest long-term inflation expectations since 1993. Wall Street stocks sank in the final week of March on the news ending a dismal quarter that saw the S&P fall more than 4% while the Tech driven Nasdaq 100 fell over 8%.

The Fed kept the federal funds rate unchanged at 4.25%-4.5% during its March 2025 meeting, extending the pause in its rate-cut cycle that began in January, and in line with expectations. Policymakers noted that uncertainty around the economic outlook had increased but anticipated reducing interest rates by around 0.5%, now revised post Trump Tariffs.

Meanwhile, US GDP growth forecasts were revised lower for this year to 1.7% from 2.1% seen in December. Growth projections were also revised down for 2026 (1.8% vs 2%). In contrast, PCE inflation is seen higher in 2025 (2.7% vs 2.5%). The unemployment rate is seen slightly higher this year at 4.4% (vs 4.3%).

The silver lining to the inflationary clouds came from the bond market as the yield on the benchmark 10 years US Treasury Note consolidated from 4.58% to 4.28% suggesting Wall Street may be overreacting. For now the Fed is simply keeping a watching brief having paused its rate cutting cycle in January upon the arrival of the Trump government but post the Tariff announcements this will likely be revised.

In the UK, the Bank of England (BOE) voted 8-1 to keep the Bank Rate at 4.5% during its March meeting, as policymakers adopted a wait-and-see approach amid stubbornly high inflation and global economic uncertainties. At its previous meeting in February, the BOE cut its rate by 25bps to 4.5% to mark the third rate cut since the start of its cutting cycle in August of last year.

The bank highlighted that, given the medium-term inflation outlook, a gradual and cautious approach to further withdrawal of monetary policy restraint remains appropriate. CPI inflation increased to 3.0% in January, and while global energy prices fell, inflation is expected to rise to 3.75% by Q3 2025 while global trade policy uncertainties and geopolitical risks have increased, with financial market volatility rising.

UK equities outperformed global markets during the quarter as the FTSE 100 (which is made up primarily of globally focused companies with international earnings) rose more than 5% while the domestically focused FTSE 250 mid cap index suffered opposite fortunes and fell more than 5%. In currency markets, Sterling climbed marginally in value against the US dollar rising from $1.25to $1.29, while inflationary concerns pushed the yield on the benchmark UK 10 year gilt yield from 4.57 to 4.67%

In the Eurozone, during March, the European Central Bank (ECB) lowered the three key interest rates by 25 basis points, as expected, reducing the deposit facility rate to 2.50%, the main refinancing rate to 2.65%, and the marginal lending rate to 2.90%. Inflation is projected to average 2.3% in 2025, while economic growth forecasts were revised downward to 0.9% for 2025 reflecting weak exports and investment.

During March as anticipated the People’s Bank of China (PBoC) maintained its key lending rates unchanged for the fifth consecutive month. The one-year loan prime rate (LPR), a benchmark for most corporate and household loans, was held at 3.1%, while the five-year LPR, a reference for property mortgages, remained at 3.6%. Both rates are at record lows following reductions in October and July last year. On the fiscal side, Beijing rolled out more stimulus measures earlier in the month to boost domestic demand and consumption and mitigate the impact of rising tariffs imposed by the US Trump administration.

In the land of the rising sun, the Bank of Japan (BoJ) as anticipated kept its key short-term interest rate at around 0.5% during its March meeting, maintaining it at its highest level since 2008. This follow the BOJ’s January rate hike and reflects a cautious stance, focusing on assessing the impact of rising global economic risks on Japan’s fragile recovery, amid higher U.S. tariffs and headwinds from overseas conditions. Inflation expectations increased moderately, with underlying CPI projected to rise gradually.

Global oil prices remained relatively subdued for the second quarter trading in a $15 range between $68 and $79 and ending the quarter at around $70, and suggesting global demand continues to meet the current supply. With the exception of the occasional Middle Eastern conflict exchange, the oil price looks relatively comfortable within this trading range for the foreseeable future.

The price of gold bullion continues apace, rising incredibly almost another 18% since the beginning of the year. Historically when the price of bullion rises, it usually is because the market is anticipating inflation. With the uncertainty introduced into traditional investment markets including a return of future inflation, the gold bull market could be set to continue for a while yet.

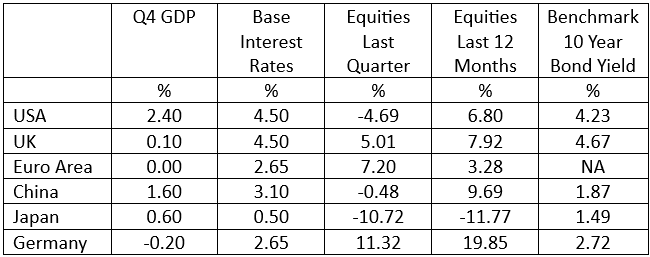

GDP Data shown are to the 31st December 2024; Interest Rate, Equity & Sovereign Benchmark Bond Yield Data are to the 31st March 2025; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzhen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Benchmark Sovereign Bond Yield Data courtesy of Trading Economics.

Current Considerations

After months of speculation surrounding the Trump tariffs and their likely consequences, the gloves finally came off in early April with the President announcing a base levy of 10% affecting the imports of almost every country that sells goods into the US and substantially higher levies for many key trading partners. The tariffs included goods from China charged at 34% and the European Union at 20%, while the UK has thus far benefitted by no longer being a part of the EU with just a flat 10% levy.

President Trump’s justification for the different tariffs charged is based on what he claims are half the reciprocal import levies each country charges for US goods entering their economies. In addition to the country specific tariffs, there is a blanket 25% import tax on all imported motor vehicles regardless of where they come from.

Opposing sides of both the political and economic spectrums have each held strong views about both the legitimacy and likely impact of the Trump tariffs and these intensified further following their introduction on the 3rd April which the President dubbed Economic Independence Day. The Economist newspaper ran with the headline, “President Trump’s mindless tariffs will cause economic havoc”, while suggesting it was a return to a 19th century trading mentality.

However it could be argued that what Trump is doing, albeit not without huge potential economic risk to both the US and global economy, is to try to reverse decades of destruction of the US manufacturing base following the ravages of globalisation. While America’s working class and latterly middle class suffered during this process, the benefactors were third world countries like China that were industrialising, as well as wealthy business owners, who outsourced their factories from expensive labour markets like the US (and to a lesser extent UK and Europe) to Asian markets where labour costs are significantly less.

A dire warning that proved incredibly accurate of how globalisation would play out for developed markets like the US, UK and Europe at the expense of labour in a race to the bottom on wage costs while maximising profits for business owners was made by British industrialist and billionaire Sir James Goldsmith in a famous interview with Charlie Rose on American TV back in 1994. He warned that, when you destroy the equilibrium relationship between capital and labour which had existed in the developed markets post-industrialisation, you run the risk of totally destabilising society in a race to the bottom for wages.

Accordingly, Trump appears to be trying to keep his election promise to American workers and bring back manufacturing to the US which, if successful, will, in the long run, boost employment and economic growth. In a nutshell President Trump is seeking to strengthen the United States’ supply chain sovereignty and ensure that, if the American economy is going to make products such as motor vehicles, it can purchase the raw materials such as steel or aluminium from factories in America employing American workers, as opposed to having to import them.

This argument from the Trump administration extends to most areas of the US economy and in boosting its supply chain sovereignty and putting America first, it will also be boosting its own and its allies defence security. The rationale for this is that if you get into conflict or a war with a major economic competitor like China, your potential position will be much weaker if the materials you need for your military have to be sourced from outside the US and potentially from the very same countries you are in conflict with.

However regardless of how commendable or desirable Trump’s long-term objective is, there can be little denying that it has serious economic risks as the retaliatory actions of China the day following the implementation of the US tariffs already suggest. This is why Wall Steet and global stock markets plunged on the day the tariffs were announced and then again the following day when China announced its retaliatory plans.

Following an already disappointing first quarter that saw declines for the S&P of 4.7%, the Nasdaq 100 of 8.53% and the Dow Jones Industrial Average (DJIA) of 1.75%, the Trump Tariff shockwaves at the end of the first trading week in April saw the Wall Street benchmark indices plummet further with their biggest one day falls since Covid on the Thursday and Friday, and Year to Date declines for the S&P 500 of 13.54%, the Nasdaq 100 of 17.06% and the DJIA of 9.62%.

Stock markets all around the world faced similar steep declines on the Friday 4th April with the FTSE 100 suffering its biggest one day fall since March 2020 as it declined 420 points, or 5%, to close at 8,055, its lowest level since mid-November. Concerns about the impact on economic growth resulted in the 10-year gilt yield falling to 4.4%, its lowest level since mid-December, and markets are now pricing in approximately 0.70% interest rate cuts by December, compared to 0.43% previously.

A long-drawn-out global trade war is unlikely to have any winners and this also explains why the price of crude oil plummeted on the announcement of the tariffs in anticipation of slowing global growth. Renowned market analyst David Rosenberg summed it up in an interview on the day the tariffs were announced when he suggested investors could be faced with months or even several quarters of uncertainty which is not conducive to stable markets.

Rosenberg believes Trump’s trade escalation is a massive upheaval and likely to be deeply damaging to businesses, consumers and entire economies. He reiterated the views of many other analysts in suggesting that it will cause households and businesses that make up the private sector economy to pull back on their spending, and potentially push the US into recession or even stagflation since in the short term the consequences are likely to be inflationary.

With uncertainty prevailing investors have been fleeing to the security of the US Treasury market where the yield on the US 10-year Treasury note fell to a six-month low of 3.96% on Tariff Friday . The US jobs market remains strong as 228,000 jobs were added in March, beating expectations of just 135,000 but Fed Chair Jerome Powell warned that tariffs could have a greater-than-expected inflationary economic impact resulting in markets now pricing in at least four quarter-point rate cuts this year, and the possibility of a fifth.

Forward Outlook

Inevitably with so much economic uncertainty following the Trump Tariffs, many analysts and market commentators have once more been suggesting that the dollar will be more vulnerable than ever and will come under increasing pressure to retain its role as the reserve currency. These views of course are reinforced by the precarious fiscal and monetary debt position of the world’s largest economy with the total government debt now at around $36 trillion or 122% of GDP and the Federal Budget deficit at over $2 trillion despite Trump’s newly launched D.O.G.E. (Department of Government Efficiency) headed by Elon Musk busily trying to cut unnecessary expenditures.

However the reality is that the dollar will remain the global reserve currency for the foreseeable future and also likely remain relatively strong against other fiat currencies simply because the offshore euro-dollar market of external USD denominated liabilities is reckoned to be in excess of $400 trillion! For this reason, and unlike what has happened to other countries when their debt to GDP has exceeded 100%, the US is unlikely to ever suffer hyperinflation because those global liabilities cannot be inflated away.

Hence we are left with what analyst Brent Johnson has described as the Dollar Milkshake Theory, which states that the US enjoys exorbitant privilege due to the fact that there is always more demand for the dollar than there is supply. The theory holds that when eventually global sovereign debt unravels, the USD will soar to all-time highs relative to other fiat currencies, while its government debt devalues, but its US stocks rise and gold rises as capital runs into dollar denominated assets.

Alternatively it is possible that in due course as suggested by the current administration we could see some form of US digital currency replace the dollar but that would still mean everything being relatively denominated and priced against the assets of America. This is a complex subject involving stable coins and other digital assets which we shall cover in more detail in a future Market View.

The Trump Tariffs have also increased the geopolitical tensions between the US and China which were already at dangerous levels due to numerous other considerations including concerns over cyber-attacks. Additionally while relations between the US and Russia are much more relaxed under Trump than they were under Biden, the Middle East situation involving Iran, and some of its terrorist proxies in other parts of the region such as Hezbollah in Jordan and Yemen, has if anything intensified under the Trump regime, while the Ukraine Russia conflict for now also remains unresolved.

Accordingly, for now, as investors we have to be cautious, until the uncertainty created by the Trump Tariffs begins to clear and the likely future trade model is more certain. Between now and then there will undoubtedly be buying opportunities in global stocks and particularly in those on Wall Street focused on Artificial Intelligence and energy saving technologies.

We shall continue to watch the direction of the oil price to give an indication of just how robust the underlying global economy is, and to gauge the true potential of the AI driven market bubble as this will undoubtedly require an unprecedented amount of energy to power it.

Prior to Tariff Thursday, investors in the UK had been well rewarded with encouraging returns from large international stocks, while the domestic focused mid and small cap sectors fell. If the dollar milk shake theory holds its ground, then investors in the FTSE 100 will benefit over the long term as the index historically has performed well when the dollar is rising against other fiat currencies.

Maintaining a well-diversified and balanced portfolio remains key while we navigate a potential forthcoming recession. For now, we continue to advise a defensive portfolio allocation with an emphasis towards value and income. Allocation to Fixed Interest will be largely maintained via actively managed Bond and Multi Asset funds with a view to providing additional diversification and the potential to take advantage of future growth opportunities as they present themselves.

As always, investment risk is at the forefront of our advice. Whilst it is often necessary to undertake adjustments in portfolio allocation to meet individual needs and preferences, we are confident that our advised portfolios will continue to remain well placed in meeting our clients’ overall objectives.

Copyright © Ash-Ridge Asset Management 6th April 2025.

Data Sources: Art Berman: Bank Of England: Bloomberg; Brookings Institute; Economic Cycle Research Institute; European Central Bank; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macrotrends: Macro Voices; National Bureau of Statistics China; Office for National Statistics; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.