Market View - 3rd Quarter 2025

“The Federal Reserve left the federal funds rate unchanged at 4.25%–4.50% for a fourth consecutive meeting in June 2025.”– Source: Trading Economics 18th June

“The yield on the US 10-year Treasury note dropped to around 4.22% on Tuesday, its lowest level in two months, as mounting concerns over the US fiscal outlook and trade-related uncertainties pressured sentiment. Markets are closely watching the Senate’s efforts to pass President Trump’s sweeping tax-cut and spending bill ahead of the preferred July 4 deadline. The package is projected to add $3.3 trillion to the national debt, raising alarm over long-term fiscal sustainability. At the same time, investors are awaiting developments on trade negotiations with key US partners, as Trump’s 90-day reprieve on broad reciprocal tariffs is set to expire next week. Further downward pressure on yields came from bets on deeper Federal Reserve rate cuts, driven by dovish signals from policymakers and continued pressure from Trump to ease monetary policy.” – Source: Trading Economics 1st July

LAST QUARTER REVIEW

Most global equity markets more than made up for the losses sustained in the first quarter due to concerns about the economic impact of the Trump tariffs, and also managed to shrug off the growing tensions between Israel and Iran. Significantly, Wall Street indices are now comfortably in positive territory year to date despite the unprecedented historic valuations as the S&P 500 and Nasdaq 100 hit new record highs gaining 10.57% and 17.64% respectively during the quarter while the Dow Jones Industrial Average rose 4.98%.

At its June meeting of the Federal Open Markets Committee (FOMC), the Fed downgraded its GDP growth forecast for 2025 to 1.4% (from 1.7% in March) and for 2026 to 1.6% (from 1.8%), while leaving the 2027 estimate unchanged at 1.8%. The unemployment rate is now expected at 4.5% in both 2025 and 2026 (compared to 4.4% and 4.3%, respectively), and for inflation, the Fed sees the PCE (Personal Consumption Expenditures) rate at 3.0% in 2025 (from previously 2.7%), easing to 2.4% in 2026 (from 2.2%), and 2.1% in 2027 (from 2.0%).

While the Fed continues to worry about inflationary threats, the bond market appears to be signalling deflation as the US Treasury yield curve began un-inverting during the quarter. The yield on the benchmark 10-year US Treasury Note at 4.24% was little changed from the 4.27% at the end of March, while the interest rate payable on the 4-week Bills is now just 4.22% compared to 4.38% at the end of last quarter and having first fallen below the Fed’s base rate floor of 4.25% on the 12th June and remaining below the official floor since then.

The US dollar declined markedly from around 104 on the DXY (a basket of other currencies weighted on market size) to less than $97. The fall in the greenback appeared due to a combination of reasons including the uncertainty surrounding the economic impact of the Tariffs and the realisation that the Fed may have to cut interest rates during 2025 more than previously envisaged.

In the UK, the Bank of England (BOE) voted 6-3 to keep the base rate at 4.25% at its June meeting, noting continuing concerns about global uncertainty and persistent inflationary pressure. Three members wanted a 0.25% percentage point cut to 4%, citing weaker underlying GDP growth, and a loosening labour market but the concerns of the majority about potentially continuing inflationary pressures from higher energy costs exacerbated by the Middle East tensions and continuing tariff uncertainty, resulted in caution prevailing and the rate remaining at 4.25%.

While the FTSE 100 (which is made up primarily of globally focused companies with international earnings) rose 2.08%, the domestically focused FTSE 250 mid cap index rose an impressive 11.04% to more than make up for its 5% fall during the first quarter. In currency markets, sterling continued its 2025 appreciation against the US dollar rising from $1.29 to $1.37, while the bond markets deflationary concerns pushed the yield on the benchmark UK 10-year gilt yield down from 4.70% to 4.49%.

In the Eurozone, the European Central Bank (ECB) at its June meeting cut key interest rates by 0.25% to 2.15% following encouraging inflation data suggesting its 2.0% target rate for 2025 is being achieved, with projections for 1.6% in 2026 (1.9% previously), and 2.0% in 2027. GDP growth is forecast to be 0.9% in 2025, 1.1% in 2026, and 1.3% in 2027, supported by higher real incomes, strong labour markets, and rising government investment, but trade tensions could affect these.

During June, the People’s Bank of China (PBoC) once again maintained its key lending rates at record lows. The one-year loan prime rate (LPR), a benchmark for most corporate and household loans, was held at 3.0%, while the five-year LPR, a reference for property mortgages, remained at 3.5%. In Mya, the central bank had reduced borrowing costs by 0.1% to help cushion the economy from the impact of new US tariffs, which was followed by recent deposit rate cuts by major state-owned banks..

The Bank of Japan (BoJ) as anticipated kept its key short-term interest rate at 0.5% during its June meeting, maintaining it at its highest level since 2008, and reaffirming the central bank’s cautious stance amid escalating geopolitical risks and continuing uncertainty over U.S. tariff policies. As part of its gradual policy normalization, the BoJ will cut Japanese government bond purchases by JPY 400 billion each quarter through to March 2026.

The oil price at one point reached $75 (its highest in 5 months), during the Middle East conflict between Israel and Iran in June, but once the peace treaty was announced, the cost of a barrel of WTI (Western Texas Intermediate) dropped to around $65, little changed from the end of March but substantially higher than $55 – $65 range seen through much of the quarter. Gold meanwhile climbed further from $3100 an ounce to $3308 while silver ($34 to $36.10) and platinum ($1004 to $1348) also rose as investors looked for safe heavens.

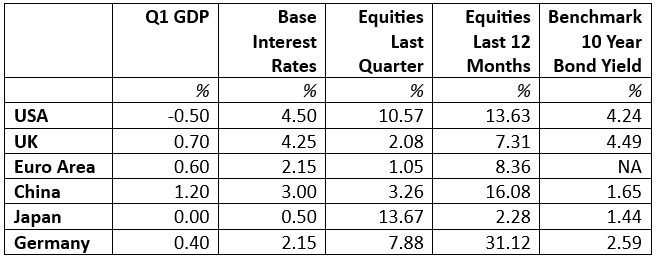

GDP Data shown are to the 31st March 2025; Interest Rate, Equity & Sovereign Benchmark Bond Yield Data are to the 30th June 2025; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzhen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Benchmark Sovereign Bond Yield Data courtesy of Trading Economics.

CURRENT CONSIDERATIONS

Investors who did not panic by reducing their equity market exposure at the beginning of the last quarter following the plunge in valuations during March were rewarded by a bounce on Wall Street and elsewhere during the past quarter. The market’s recovery was driven by a realisation that the Trump administration is prepared to be both flexible and pragmatic in its tariff negotiation and that shocking headline soundbites that threaten to disrupt global trade irrevocably are usually just rhetoric designed to ensure the carrot will work and the stick will be unnecessary.

However, dark clouds have developed in respect of both the economic outlook and also the geopolitical picture. The latest employment data in several leading economies is most concerning, while tensions in the Middle East increased exponentially following Israel’s decision in Mid-June to pre-emptively try to destroy Iran’s ability to develop a nuclear threat.

Economically, while the rhetoric from the Fed and BOE continues to emphasise inflationary risks the data is suggesting the opposite and signalling deflation! Most importantly the world’s most important debt market, US Treasuries is signalling lower interest rates along the curve which means that as the yield curve un-inverts, interest rates at the short end will fall faster than at the long end.

This is what’s known as a bull steepener which is the opposite of a bear steepener when the curve un-inverts through interest rates at the longer end rising more quickly than those at the shorter end. The latter development is what most economists and market analysts including all the bond vigilantes have been forecasting for some time is the more likely scenario.

Many of these analysts and economists, when faced with recent yield curve developments signalling lower interest rates, have resorted to suggesting the bond market is wrong. However history shows every previous yield curve un-inversion proved accurate with respect to the outcome it was signalling.

Importantly the most recent economic data coming from both the US and other major western markets suggests the bond market is right again, and that disinflation and ultimately deflation are now clearly on the horizon. This means several leading central banks including the Fed and BOE that are still focused on inflationary fears, will soon have to switch tack and join the race to the bottom on base rates if they want to avoid their economies suffering a prolonged recession.

The latest forecast from the IMF confirms that the outlook for global economic growth through to 2030 at 2.3% means this will be the weakest decade since the sixties. In the world’s largest economy, GDP data for the first quarter showed the American economy shrank by 0.5%, the first quarterly contraction for three years.

In the UK, the employment data looks ominously worrying as in the last 4 months to the end of May, 227,000 jobs have been lost – this was the seventh straight month when payrolls declined! Like the Fed, the BOE’s rhetoric continues to be about inflation threats but the economic data suggests recessionary fears as the unemployment numbers have recently hit 4.6%, the highest since August 2021.

Market analysts and investors who suggest US Treasury yields must rise due to the excessive debt liabilities of the government currently sitting at almost $37 trillion or 126% of GDP, forget the influence of the offshore eurodollar market. This offshore dollar denominated trading mechanism dwarfs the domestic market at more than 10 times the total of the US debt, suggesting the likelihood of a shortage of buyers for US Treasuries and dollars is vastly exaggerated.

As tensions in the Middle East continue to worry markets, and occasionally as in late June look like they could lead to a third world war between the US (pro Israel) and Russia (pro-Iran) with possibly China also being dragged in, the demand for safe haven assets is likely to remain high. Once investors realise that the primary global economic concern has switched from inflation to deflation, the demand for other safe haven assets such as gold and oil will probably diminish, especially as the former has no yield and the latter is likely to experience a glut of supply versus falling demand in a slowing global economy.

This is unlikely to be the case for US Treasuries, where investors will want to reverse recent trends and increase allocations to the asset class in order to try and capture some of the yield steepener bull market. The bond market signal is telling us yields will fall all the way along the curve but will fall more sharply at the shorter end as the un-inversion progresses over coming months, until the whole Treasury interest rate curve has resumed its usual shape with higher yields for longer duration.

Bond vigilantes and central bank economists during the first half of the year have insisted inflation remains a threat and that it will only be a matter of time before the yield at the longer end of the curve (and especially the 10-year Note, the 20-year bond and 30-year bond) soars. However 2025 started with the yield on the benchmark 10 year note at 4.57% and now sits at just 4.24% and never once exceeded 5% despite all the inflationary rhetoric, while the 30-year bond began 2025 at 4.79% interest and is unchanged at 4.79% six months later.

The bond market signal is clear and has remained consistent for some time – soon investors will realise it is the Fed and other central banks that have misjudged the data and kept interest rates elevated too long. In order to ensure damage limitation and try to prevent their economies going into recession, the Fed and other central banks will now have to move swiftly with base rate cuts if they want to get back in front of the bond market interest rate curve!

The increased Middle East tensions, and military exchanges between Israel and Iran have caused the oil price to once again move above $70 a barrel, and many are speculating this could rise much more if a long-term peaceful resolution is not achieved. If peace prevails, the recent bearish projection from Goldman Sachs on the outlook for the oil price looks realistic based on supply (including the commitment of the OPEC+ countries to increase production by 0.41 million barrels per day) comfortably exceeding demand due to slowing global economic growth.

Goldman’s projections which were published in early June prior to Israel bombing Iran, suggest Brent crude will average $60 per barrel and WTI $56 per barrel for the remainder of 2025. For 2026, they envisage Brent at $56 and WTI at $52 per barrel. However if a lasting settlement with Iran is not forthcoming, and the conflict escalates, we could easily see the price rocket through $100 and even $200 short term, especially if the important Straits of Hormuz trading route becomes too dangerous.

FORWARD OUTLOOK

As we suggested in the last update, we believe the dollar will remain the global reserve currency for the foreseeable future and remain relatively strong over the medium term against other fiat currencies thanks to the offshore euro-dollar market of external USD denominated liabilities, estimated to be worth more than $400 trillion. For the same reason it is unlikely the demand for US Treasury debt from global investors and traders will diminish in the foreseeable future.

This offshore shadow banking monetary system is a mystery to many central bankers and economists because it exists outside their control and jurisdiction. Meanwhile, recent data from both the US economy and elsewhere suggest that whatever inflationary pressures existed in the global economy have now dissipated, and the immediate threat is declining growth and deflation.

Unfortunately, the Fed and the BOE, as so often in the past appear to be behind the interest rate curve, and risk economic recession if they delay too long. Inevitably short-term market noise from tariff and geopolitical tensions in the Middle East and Eastern Europe will from time-to-time cause energy prices to spike and cause renewed temporary inflation pressures, but the long-term secular trend is likely to remain deflationary.

In the equity market, consensus sentiment seems to suggest investors will likely reduce allocations to highly valued popular Wall Street tech stocks such as the Magnificent 7 in favour of increased diversification into undervalued investments elsewhere, including Europe and the UK. However realistically, this is likely to be at best a temporary diversification trend in any volume since the primary determinants of allocation on Wall Street and increasingly in all other global equity markets are indexed funds.

Indexed fund investment as we have examined and discussed in detail previously, has no sentiment when it comes to value or rationale. For that reason, and despite the unprecedented valuations, the likelihood is that large cap Wall Street tech stocks invested in both Artificial Intelligence and optimal energy strategies that will be needed to develop AI, will continue to attract new monies.

While the slowdown in the US and global economy that is being signalled by the bond market may cause a temporary setback in the values of these stocks, this will likely present another long-term buying opportunity for any portfolios that are underinvested. Opportunities elsewhere in global equities are also likely to develop once we know the likely extent of the global growth slowdown including in the UK which remains relatively undervalued and which typically tends to outperform when the dollar is strong against other currencies.

UK equities should benefit enormously from the Labour government’s Pensions Schemes Bill which is anticipated to inject over £25 billion into the UK economy, supporting crucial capital for high-growth businesses and infrastructure projects. With greater consolidation, scale, and alignment between pensions and the real economy, we now have the opportunity to secure better outcomes for savers and long-term investment in the future of the UK.

According to research by the think-tank New Financial, UK pension funds had close to 50% of their assets invested in domestic stocks as recently as 2000, but this had dropped to just 4% by last year! However a June 19th article in the FT titled, “Scottish Widows to slash UK equity exposure” explains how SW which manages a total of £72 billions of workplace pension assets plans to cut its exposure to UK equities from 12% to 3% in its highest growth option, and from 4% to 1% in its most conservative portfolio, while increasing the North American exposure in both plans from 46% to 65% and 17% to 25% respectively.

Maintaining a well-diversified and balanced portfolio remains key while we navigate what now appears a strong possibility of a forthcoming recession. For now, we continue to advise a defensive portfolio allocation with an emphasis towards value and income.

As the economic picture becomes clearer, we shall also look to increase our exposure to bond investments as the US Treasury yield curve un-inverts. Allocation to Fixed Interest will be largely maintained via actively managed Bond and Multi Asset funds with a view to providing additional diversification and the potential to take advantage of future growth opportunities as they present themselves.

As always, investment risk is at the forefront of our advice. Whilst it is often necessary to undertake adjustments in portfolio allocation to meet individual needs and preferences, we are confident that our advised portfolios will continue to remain well placed in meeting our clients’ overall objectives.

Copyright © Ash-Ridge Asset Management 1st July 2025.

Data Sources: Art Berman: Bank Of England: Bloomberg; Brookings Institute; Economic Cycle Research Institute; eurodollar.UNIVERSITY; European Central Bank; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macrotrends: Macro Voices; National Bureau of Statistics China; Office for National Statistics; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.