Market View - 4th Quarter 2021

“Fear and hope remain the same; therefore, the study of the psychology of speculators is as valuable as it ever was. Weapons change, but strategy remains strategy, on the New York Stock Exchange as on the battlefield. I think the clearest summing up of the whole thing was expressed by Thomas F. Woodlock when he declared: “The principles of successful stock speculation are based on the supposition that people will continue in the future to make the mistakes that they have made in the past.”

Edwin Lefèvre, Reminiscences of a Stock Operator

LAST QUARTER REVIEW

Whilst the last quarter saw a mixture of encouraging economic news, early equity gains were negated in the second half of September, largely as a consequence of the increasing prospect of inflation and developments in China, where the central bank (PBoC) moved to ban cryptocurrencies amid mounting concerns over a potential default from Evergrande, the huge Chinese property developer. We looked in some detail at the arguments for both the cyclical and secular inflation case in the previous Market View and consider this quarter how the Fed and other Western Central banks are responding to the latest data.

On Wall Street, investor enthusiasm was much more constrained than during the second quarter, with major indices providing mixed results as the S&P 500 climbed just 0.23%, while the Nasdaq 100 fell 0.38% and the Russell 2000 representing smaller domestic focused stocks declined 4.6%. Wall Street’s equity indices had looked to book impressive gains during the quarter before dramatically reversing direction in the latter half of September. Inflationary concerns also unsettled bond investors as yields on US Treasuries soared during September with the benchmark 10 year government bonds yielding 1.52% at the end of the quarter (1.45% end June) and 30 year bonds yielding 2.08% (2.06% end June).

In the UK, mid cap and smaller company stocks continued to do well as the FTSE 250 climbed 2.93% and the FTSE SmallCap 1.58%, while the large cap focused FTSE 100 climbed just 0.70% and remains massively undervalued relative to its peers on both Wall Street and Europe and on an historic comparative basis. During the first nine months of 2021 the FTSE Small Cap index is up 19.98% and is one of the best performing of all global indices so far this year.

While the yield on US Treasuries remained broadly unchanged over the quarter, the trend has been gently upward since the 4th August when the interest rate on the 10 year benchmark hit 1.19%. and on the 30 year-long bond 1.83%. In the UK, on the other hand, yields have been climbing much more steeply from an early August low of 0.518% on the benchmark 10 year gilt to 1.017% at the end of the quarter suggesting a greater concern for inflationary pressures this side of the pond.

Following the Federal Reserve (Fed) September meeting of its Federal Open Market Committee (FOMC), its statements suggest that, as the US economy continues to progress towards its employment and inflation targets, a moderation in the pace of its asset purchases (currently $120 billion a month) is likely to begin. The Fed also signalled interest rate increases may follow more quickly than expected, as half its 18 policymakers projected borrowing costs will need to rise in 2022.

The Fed anticipates the American economy will grow by 5.9% in 2021, less than the 7% projected by the central bank in June, while expecting GDP to expand faster in both 2022 (3.8% vs 3.3% in the June projection) and 2023 (2.5% vs 2.4%). It sees inflation (as measured by the personal consumption expenditures index), higher in 2021 (4.2% vs 3.4%) and in 2022 (2.2% vs 2.1%), with the unemployment rate also higher this year (4.8% vs 4.5%).

In the UK, during its September meeting, the Bank of England (BOE) left its benchmark interest rate unchanged at a record low of 0.1%, and likewise its bond-buying program remained unchanged at a total of £895 billion by the end of 2021. The British central bank stated the case for modest tightening strengthened from August, and that inflation could persist above 4% well into 2022.

At the September meeting, two policymakers voted for an early end to government bond purchases compared to one in the August meeting. Meanwhile, growth expectations for the third quarter’s GDP were lowered by almost 1% to around 2.5% below its pre-Covid level.

In the German elections, Olaf Scholz’ Social Democrats gained the largest share of the vote with 25.8%, followed by Chancellor Angela Merkel’s conservatives with the prospect of months of negotiations ahead before a new coalition can be agreed. The European Central Bank (ECB) kept interest rates at record-low levels but advised it would soon begin conducting a moderately lower pace of net asset purchases under the “Pandemic Emergency Purchase Programme” (PEPP) for the rest of the year due to improved economic and financial conditions. The ECB reiterated, however, that the PEPP capacity would be maintained at €1.85 trillion until at least the end of March 2022 and beyond if necessary until it is satisfied the crisis is finally over.

The ECB is also more concerned than previously about inflation and now expects 2.2% in 2021 (vs 1.9% estimated in June), 1.7% in 2022 (vs 1.5%) and 1.5% in 2023 (vs 1.4%). The good news however is that it has also increased its forecasts for economic growth in the next couple of years to 5% in 2021 (vs 4.6%), 4.6% in 2022 (vs 4.7%) and 2.1% in 2023 (vs 2.1%).

Meanwhile the Bank of Japan (BOJ) following its September meeting also left its key short-term interest rate unchanged at -0.1% and kept the target for the 10-year government bond yield at around 0%. The Japanese economy expanded 1.9% in the second quarter, compared with market forecasts of 1.6%, and the central bank expects little change in economic growth or inflation going forward and will start to roll out climate change loans in December.

In the currency markets, the US dollar was little changed against a basket of currencies as measured by the popular DXY index; likewise the sterling dollar rate was broadly unchanged over the quarter ending at $1.3467. Gold bullion was more volatile over the quarter but ended at $1756 an ounce, little changed from its $1768 price on the 30th June, while the price of West Texas Intermediate (WTI) crude oil which had sunk to just over $60 a barrel mid quarter, surged in September to end the quarter little changed at $75.

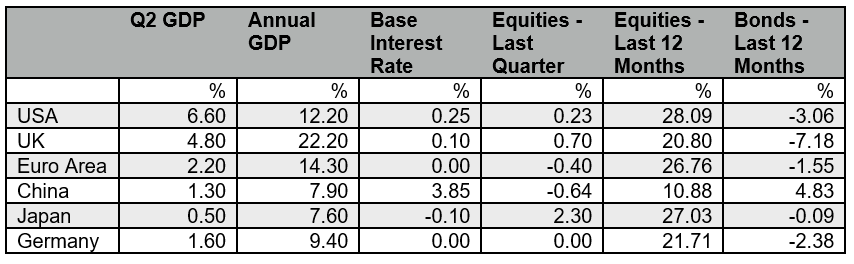

GDP Data shown are to the 30th June 2021; Interest Rate, Equity & Bond Index Data are to the 30th September 2021; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Sovereign Bond Indices used: S&P US T-Bond, S&P UK Gilt Bond, S&P Eurozone Sovereign Bond (Eur), S&P China Bond, S&P Japan Government Bond, S&P Germany Sovereign Bond.

CURRENT CONSIDERATIONS

An immediate concern for global markets is the possibility of the United States triggering a federal default on October 18th if Congress fails to raise the debt ceiling (yet again) while also passing President Biden’s ambitious $3.5 trillion fiscal spending bill. Realistically, while this is a distinct possibility as negotiations in Congress have thus far failed to persuade enough policymakers to agree the increased spending, the fact that the Democrats control both the House of Representatives and Senate should see disaster averted.

Otherwise, as has been the case for most of 2021, the key consideration for most investors remains the continuing control of the global pandemic together with future inflationary expectations. Rising concerns about the latter were all too apparent from the increased volatility of key stock indices both on Wall Street and elsewhere during the second half of September.

As always, markets in these scenarios keenly look to see what the world’s central banks, especially the Fed, have to say. Following the FOMC meeting on the 22nd September, the Fed statement included the following reassuring comments, “with progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen.”

The statement added, “the path of the economy continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy but risks to the economic outlook remain.”

The FOMC statement also said, “inflation is elevated, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.”

The Fed confirmed that it would be monitoring economic developments carefully as it pursued its usual objectives of maximum employment and medium term inflation of 2% annualised. The central bank emphasised that it was currently unconcerned that inflation is running well above the longer term target rate as it has previously under-achieved this goal over a prolonged period of time.

Accordingly, the statement confirmed that with no tightening currently necessary the central bank would continue to increase its holdings of Treasury Securities by at least $80 billion a month and of agency mortgage-backed securities by at least $40 billion a month. The FOMC statement concluded that the “Committee’s assessments will take into account a wide range of information, including readings on public health, labour market conditions, inflation pressures and inflation expectations, and financial and international developments.”

Many market analysts and commentators have questioned the Fed’s somewhat cavalier approach to allowing short term inflation to overshoot its long term objectives. They suggest this is especially risky in light of the unprecedented amount of monetary and fiscal stimulus deployed by western policymakers to kick-start their economies after the pandemic enforced recession of 2020.

The Economist recently published an article titled, “The new Powell doctrine” that quotes how in the past eighteen months the Fed has purchased more than $4 trillion in assets, thereby more than doubling its balance sheet to around $8.3 trillion, the equivalent of almost 40% of US GDP! The Economist article suggests that Jerome Powell’s biggest challenge will be determining when to begin unwinding the asset purchases as well as of course potentially when to begin raising interest rates again.

The Economist suggests that if the Fed “moves too slowly to unwind, financial markets could overheat (some prominent investors such as Jeremy Grantham argue that they are already red-hot). Move too quickly, and a market crash would be a self-fulfilling prophecy, rippling through the global economy”. For now at least, Fed chairman Jerome Powell and his fellow central bankers on the FOMC appear happy to risk moving too slowly, as they seek to nurture the American and global economies back to a more consistent growth path.

Similarly, in the UK, where the short term inflation is running above the BOE’s stated inflation target of 2% at 2.5%, the latest monetary statement from the central bank explained, “we expect above-target inflation to be temporary. We don’t think demand will continue to rise as fast and that some of the shortages, currently making it difficult for businesses to produce their products, should ease. We expect inflation to fall back, reaching our target in around two years’ time.”

The picture for the bellwether asset class of commodities that historically has signalled the onset of secular inflation remains mixed and while certain key energy components such as natural gas, and coal have more than doubled in price during 2021, others like crude oil, heating oil, and gasoline have been plateauing throughout the summer. A similar plateauing in price has occurred elsewhere in the commodities sector this year in copper, steel and wheat, while the prices of iron ore, lumber and soybeans have collapsed by similar percentages to those by which they soared in the first half of 2021.

Historically, when it comes to forecasting long term interest rates and inflation, there is no better predictor than the bond market, as the yield curve can provide investors with valuable insights as to the likely direction of inflation and long term interest rates via the change in the steepness of the slope. On the 1st January the spread or gap between the interest rates on the benchmark 10 year Treasury and the 2 year bond was 0.82%, but by the end of the first quarter, this spread has widened to 1.52% mainly as result of the yield on the 10 year Treasury rising.

Accordingly, the steepening slope of the curve had suggested the economy was accelerating and increasing inflation was around the corner. However, at the end of the third quarter, the spread is 1.24%, suggesting that rising inflation is likely to be short-lived, and disinflation will likely follow – although, of course, there are never any certainties in markets.

FORWARD OUTLOOK

Accordingly, while the data we analyse and monitor on inflation continues to suggest that the increase we have seen in 2021 is likely to be short-lived and of a cyclical nature, recent market nervousness surrounding the mixed data means increased vigilance is required. Additionally, market reaction in parts of Asia which once appeared to be ahead of the curve in terms of post pandemic progress but have since experienced setbacks with vaccination programs, suggest some caution remains warranted.

Additionally, we shall be watching developments with Evergrande, and the Chinese property sector closely as outcomes could have profound effects on both local and global markets if some of the shadow banking players are shown to be vulnerable. China’s property sector accounts for almost a quarter of its economy and an extended campaign against developer leveraged debt by President Xi, which has triggered Evergrande’s current difficulties, could significantly impact upon China’s future growth prospects.

While the commodities sector overall offers an uncertain picture for both future investment opportunities and inflationary expectations, there is currently a frenzy in the natural gas market following a global shortage. This is leading to emergency short term measures in many countries to protect consumers including in the UK where some factories are being temporarily closed, and the panic is reflected in the price of liquefied natural gas (LNG) increasing two thirds in the past month alone to $25 per million British thermal units (MBTU) as the US (the world’s biggest producer) seeks to limit exports.

The likelihood remains that the current phenomenal economic growth and inflation rates that we are experiencing in 2021 will be the highest for a long time to come. This is because the unprecedented monetary and fiscal stimulus of the last year is likely to serve only as a sticking plaster to a fatally damaged global economy that with each additional year of debt additions becomes more and more difficult to stimulate.

Arguably, as the famous McKinsey research paper published in 2008 titled, “Debt and deleveraging: The global credit bubble and its economic consequences” showed, absent willingness to embrace austerity comparable to that experienced by the Western economies post World War II, no route out of this trap exists as the overreliance on debt remains the only tool of monetary and fiscal policy. As the report observed, “austerity was followed because they either occurred in the pre-Keynesian and pre-monetarist period when major increases in debt was not an option either because of the prevailing gold standard or economic orthodoxy”, but realistically in the 21st century populations of western democracies are unlikely to be willing to undergo anything so draconian, and so central banks and fiscal policymakers will simply have to try and muddle through as best they can.

Accordingly, we remain comfortable from a portfolio diversification perspective in continuing to include some exposure to actively managed Fixed Interest funds investing in a combination of blue chip government debt and investment grade corporate bonds.

On the back of the phenomenal returns seen already in global equity markets and especially on Wall Street where valuations are a little richer than most others, we remain cautiously positive going forward. We shall continue to selectively recommend re-balancing portfolios to more defensive allocations, whilst marginally increasing exposure to UK stocks which frustratingly remain relatively cheap both from a value and relative inter-market perspective.

As always, investment risk is at the forefront of our advice and, whilst it is often necessary to undertake adjustments in portfolio allocation in order to maintain individual preferences, we are confident that our advised portfolios remain well placed in meeting our clients’ needs.

Copyright © Ash-Ridge Asset Management 1st October 2021.

Data Sources: Bloomberg; Brookings Institute; Economic Cycle Research Institute: Financial Sense; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macro Voices; National Bureau of Statistics China; Office for National Statistics; Real Vision; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal; Zero Hedge.

The Market View reflects our in house assessment and views and is posted for client interest only. Please refer to our Terms of Use at the bottom of this page.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has been advising me for over 25 years. I have seen a very significant increase in the value of my portfolios over the years and have been very impressed by their professionalism, attention to detail, hands on management and care. I have been thoroughly pleased with the service so far.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.