Market View - 4th Quarter 2024

“The Federal Reserve cut the target range for the fed funds rate by a jumbo 0.5% to 4.75%-5.00% in September 2024, the first reduction in borrowing costs since March 2020. The central bank also released new economic forecasts. Policymakers are pencilling in 1% of easing by year-end, suggesting two more 0.25% cuts this year. For 2025, an additional 1% of cuts are expected, followed by a final 0.5% reduction in 2026.” – Source: Trading Economics

LAST QUARTER REVIEW

Global equity and bond markets rallied as the Federal Reserve (Fed) finally began cutting interest rates signalling that it believes the long battle to control inflation is finally won and the focus now is upon ensuring a soft landing for the US economy. The US Treasury Yield Curve also began dis-inverting as we head into the US Presidential and Congressional election in November, the outcome of which will be a key determinant of investor risk appetite for the coming year.

Longer term US interest rates declined, fairly in line with the yield on the benchmark 10-year Treasury Note which began the quarter at 4.39%, falling to around 3.75%. When comparing the 10-year benchmark Treasury Note and the 2-year Treasury Note, the yield curve dis-inverted (or un-inverted) for the first time in almost 2 years on the 28th August when the yield on the former was 3.88% compared to 3.83% for the shorter duration, and US Treasury market yields along its constituent durations has continued flattening since the Fed cut the base rate in September.

The US dollar had begun weakening prior to the Fed’s interest rate cut and ended the quarter down more than 5% as the DXY index (a basket of other currencies) fell from 105.84 to around 100. Currency markets appear to have correctly been pricing in the Fed’s stronger than anticipated interest rate cut but, if as expected, other western economies like the UK now follow the Fed in cutting rates, the greenback is unlikely to weaken much further from here.

In anticipation that the US is now likely to avoid outright recession, Wall Street equities continued to climb to new highs. The S&P 500 gained a further 5.43%, the Dow Jones Industrials Average (DJIA) more than 8%, while the tech heavy Nasdaq 100 index was up nearly 2% after a volatile quarter which, at one point, saw the index down 10%. The seemingly crazy valuations of the largest cap stocks on Wall Street show no signs of slowing, due in no small part to the irreversible indexation trend of the past few decades.

In the UK, the Labour party won power for the first time in almost 20 years and ended the Conservatives’ 14-year term as the primary governing party. Labour achieved a 174-seat simple majority winning a total of 411 seats, but its overall share of the total vote was just 33.7%, the least share by a winning party in British electoral history according to the Gallagher index.

Labour won 211 more seats than in the previous general election 5 years ago with half a million fewer total votes and became the largest party in England for the first time since 2005. The Conservative Party was reduced to 121 seats, winning just 23.7% of total votes, its worst result in history.

The Bank of England kept the Bank Rate unchanged at 5% during its September 2024 meeting, after reducing rates by 0.25% in August, the first reduction in over four years. Markets had anticipated no further action in September as the annual inflation which was 2.2% in August, is expected to increase to around 2.5% towards the end of this year as declines in energy prices last year fall out of the annual comparison, while services consumer price inflation remained elevated at 5.6% in August.

Interest rates at the long end of the UK bond market fell in line with interest rate expectations longer term with the benchmark 10-year gilt yield declining from 4.18% to around 3.79% while Sterling rose steadily throughout the quarter from $1.26 to around £1.33 helped along by the Fed’s aggressive cut of its base rate. UK equities were broadly flat during the quarter – not surprising allowing for the fact that the FTSE 100, with an international earnings focus, tends to fare better during periods of dollar strength while the domestically focused FTSE 250 mid cap index did much better rising 3.78%.

In the Eurozone, the European Central Bank (ECB) cut the deposit facility rate by 0.25% to 3.5% to ease monetary policy restrictions, reflecting an updated inflation outlook and better transmission of policy. Additionally, the central bank announced that, from the 18th September, the interest rates on the main refinancing operations and the marginal lending facility have been lowered to 3.65% and 3.90% respectively.

As anticipated, the People’s Bank of China (PBoC) kept its key lending rates unchanged at the September fixing, with the one-year loan prime rate (LPR), the benchmark for most corporate and household loans, being maintained at 3.35% a record low. The five-year rate, which by and large is a reference for property mortgages, was held at 3.85%, also a record low.

Meanwhile the Bank of Japan (BoJ) unanimously retained its key short-term interest rate at around 0.25% during its September meeting, keeping it at the highest level since 2008, in line with market consensus. The BoJ also maintained its assessment that Japan’s economy remains on track for a moderate recovery, despite some areas of weakness as private consumption continued its upward trend, helped by improving corporate profits and business spending.

Despite the continuing conflicts in the Ukraine and the Middle East, together with geopolitical tensions in place like Taiwan, global oil prices remained subdued – West Texan Intermediate (WTI) began the quarter at around $81 a barrel but fell to below $70 and looks like it could fall further, especially in the event that a US recession should unexpectedly materialise.

Gold bullion continued to rise steadily and now sits at $2658, up almost 14% last quarter and almost 50% over the past year. The price action of gold would normally suggest that rising inflation or even hyperinflation is a possibility but other indicators suggest the exact opposite and that more likely we are back in the secular deflationary trend that has prevailed since the turn of the millennium.

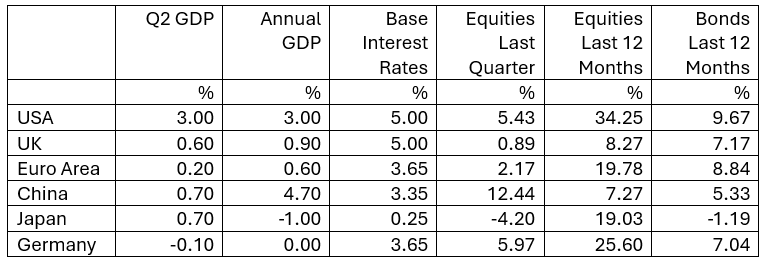

GDP Data shown are to the 30th June 2024; Interest Rate, Equity & Bond Index Data are to the 30th September 2024; Equity Indices used: US – S&P 500, UK – FTSE 100, Eurozone – Euro Stoxx 50, China – Shanghai Shenzhen CSI 300, Japan – Nikkei 225, Germany – Xetra Dax; Sovereign Bond Indices used: S&P US T-Bond, S&P UK Gilt Bond, S&P Eurozone Sovereign Bond (Eur), S&P China Bond, S&P Japan Government Bond, S&P Germany Sovereign Bond.

CURRENT CONSIDERATIONS

It appears increasingly likely the American economy will avoid recession as the US Treasury Yield Curve has begun dis-inverting for the first in almost 2 years. The yield curve is now flattening and looks set to return to a normal gently upward sloping curve with interest rates for shorter duration Treasuries offering lower returns than those at the longer end.

When the 2-year Treasury Note trades above the 10-year benchmark Note, and the yield curve is inverted, investors perceive the immediate future as more of a risk than farther out. Therefore, when risks are elevated, investors will demand a higher payout, or yield, to invest in US Treasury notes than in longer duration notes or bonds.

Despite the apparent failure of the inverted yield curve to signal recession on this occasion, the risk of recession may not be entirely ruled out as, historically, when the yield curve begins turning positive prior to the Fed beginning to lower rates, a recession has often occurred shortly afterward. However, this signal commonly referred to by economists as the dis-inverted yield curve, is much more unreliable than the once infallible inverted yield curve signal, and with the US economy continuing to power along at around 3% annualised growth, a soft landing now looks the more likely scenario.

Investors also have to consider that, in the modern world of exacerbated government debt levels, many more variables go into determining interest rates all along the Treasury duration timeline. Several leading economists are citing the labour market numbers as a much more reliable indicator of any potential recession in the current climate and while these are cooling, they remain relatively strong by historic standards.

The good news is that the four-week moving average of initial jobless claims is, with the exception of the pandemic, currently trending far below levels seen leading up to prior recessions. There are, however, other economic uncertainties, such as the oil price for example, which suggest that investors should tread with caution – at least until the conclusion of the US elections when the priorities of Congress and the new President should hopefully become clearer.

Despite the ongoing geopolitical conflicts, oil prices remained subdued last quarter suggesting that demand is weaker than many previously supposed. A barrel of West Texan Intermediate (WTI) began the quarter at around $81 and by quarter end was trading just above $68.

Increasing tensions appear to have had little long-term impact on fossil fuel prices. Oil prices appear to be in a secular bear market as evidenced by the Brent futures price falling to its lowest level in three years on the 10th September following a $12 decline in fourteen days.

A veteran oil analyst, Art Berman, observed in a recent blog, “the reality is that weak oil demand has been the main force pushing prices down in recent years, but geopolitical factors—including OPEC production cuts—have repeatedly stepped in to prop them up.” The suggestion is that the longer geopolitics artificially sustains the market, the more severe the price correction will be once the next crisis fades.

The underlying longer-term factor driving the oil price direction appears to be a lack of economic growth demand globally. This has been exacerbated, by China, who was one of the biggest oil consumers pre-pandemic and has not resumed anything like a similar demand for fossil fuels since.

Art observes that transportation is responsible for 60% of global oil consumption, and that gasoline and diesel account for 54% of total petroleum use. The Energy Information Administration (EIA) in its latest international Energy Outlook projects that world diesel consumption would only increase about 1 million barrels per day by 2035, and that gasoline use would probably decrease about 1.4 million barrels per day.

While it’s difficult to get reliable data on current world consumption by fuel type, a good proxy is likely to be the United States which is a major exporter. Over the past two years, the amount of crude oil going into U.S refineries has stabilized at more than 1 million barrels a day lower than the 2018-2019 average levels, with roughly half of that decrease due to lower U.S. consumption, while the rest reflects lower global demand.

Art also observed that U.S. export levels signal a decrease in global demand year-over-year as the data for 2023 and 2024 revealed growth in U.S. crude oil and petroleum product exports has dropped by an extraordinary 40% compared to the levels seen between 2017 and 2019. Meanwhile markets have made their stance abundantly clear – as at the end of September, fund managers held a net short position in Brent crude oil futures and options suggesting oil traders are more bearish now than at any point in the history of the Brent futures market.

Meanwhile as we have on several previous occasions observed that the elephant in the room for markets, especially on Wall Street, remains the influence of indexed funds. The way the algorithms and mechanical momentum of these non-value evaluating funds work, results in more of the most highly valued stocks and less of the value stocks being bought in almost all market scenarios.

Price discovery and value mean nothing to an algorithmic index fund which is programmed to buy regardless of fundamentals and in the percentages represented in the index. Naturally this means the magnificent seven which dominate the main large cap indices on Wall Street keep on getting bigger, while more fundamentally attractively priced value funds become increasingly more undervalued.

Many market historians and analysts have begun to compare these expensive giant stocks to the vastly overvalued Nifty Fifty that dominated Wall Street during the roaring twenties prior to the 1929 crash. It therefore makes sense for risk averse investors to exercise caution and to look to counter some of these risks with allocations to other asset classes and more reasonably valued stock markets such as the UK.

FORWARD OUTLOOK

The economic and financial data fog, that we referred to last time as being the main challenge for investors, has lifted a little during the last quarter with the US Treasury yield curve dis-inverting following the Fed’s commencement of cutting base rates. We also have a new government in the UK that has a clear mandate for the next several years.

The key missing piece of the fiscal and economic jigsaw is the outcome of the US election. Markets appear to be factoring in a “split party government” with neither the Democrats nor Republicans controlling all three legislatures of the White House, the Senate and the House of Representatives.

Ongoing conflicts in the Middle East and Ukraine continue to exacerbate market uncertainty – whilst there is no way of knowing how these theatres will play out, we can only hope and pray that cool heads prevail.

This aside, current data does support the view that the global economy is in relatively good shape. The one flashing red light we must keep watch of however is the price and underlying demand for oil which suggests the global economy may not be as robust as current headline numbers might suggest. While there can be no denying that the demand for fossil fuels is likely to remain for decades before greener and cleaner energy gets anywhere near being ready to replace it, consumption data of the past few years would indicate that we are post growth energy, at least for now.

Accordingly, with the interest rate cutting cycle now clearly underway in the US, UK and Europe, having exposure to US Treasuries and other quality government debt and high yielding investment grade bonds within portfolios becomes an even more sensible option. As we have previously suggested, a new US Treasury bull market looks like it may have commenced in late 2023 and is likely to continue for several years more.

In the UK, investors this year have finally seen some reward for their patience with encouraging returns from both large international and domestically focused stocks alike. We expect these markets to continue to reward investors going forward with the FTSE 100 benefitting additionally when the US dollar is strong, and Mid-Caps and Small Caps continuing to offer value on the back of an improving UK economic outlook.

As always, maintaining a well-diversified and balanced portfolio remains key, and, in view of the current uncertainties, we continue to advise a defensive asset allocation with an emphasis towards value and income at this time. Allocation to Fixed Interest will be largely maintained via actively managed Bond and Multi Asset funds with a view to providing additional diversification and the potential to take advantage of future growth opportunities as they present themselves.

As always, investment risk is at the forefront of our advice. Whilst it is often necessary to undertake adjustments in portfolio allocation to meet individual needs and preferences, we are confident that our advised portfolios will continue to remain well placed in meeting our clients’ overall objectives.

Copyright © Ash-Ridge Asset Management 1st October 2024.

Data Sources: Bank Of England: Bloomberg; Brookings Institute; Economic Cycle Research Institute; European Central Bank; Financial Times; German Federal Statistical Office; Hoisington Investment Management; Macro Voices; National Bureau of Statistics China; Office for National Statistics; S&P Indices; The Cabinet Office Japan; The Economist; The Federal Reserve; The National Bureau of Economic Research; Trading Economics; UK Debt Management Office; US Debt Clock.org; Wall Street Journal.

Our testimonials

I first met Anthony Kynaston some 13 years ago, when I sought advice regarding an inheritance from my late parents. He immediately impressed me with his friendly, calm, clear and professional manner, ascertaining my individual needs. Tony has since then continued to advise, plan and manage my financial affairs. This includes advice on my Buy to Let property and pension needs. He and his colleagues are always available to assist with any queries I may have. As a result, I can relax and now enjoy my retirement, leaving the complexities of financial management in their safe hands.

Ash-Ridge has been advising me for over 25 years. I have seen a very significant increase in the value of my portfolios over the years and have been very impressed by their professionalism, attention to detail, hands on management and care. I have been thoroughly pleased with the service so far.

Ash-Ridge has provided myself and my family with friendly, professional financial advice for many years. I find them trustworthy and reliable, and would not hesitate to recommend them.

I have been working with Tony and Andrew at Ash-Ridge to manage my financial affairs for several turbulent years since 2007. They have supported me with a variety of significant decisions and administration relating to pensions and investments while dealing with ever-changing circumstances as I moved into retirement. I am very happy to work with them, and to recommend their services.

Ash-Ridge have been managing my personal pension investment portfolio for two years. I can say that I am absolutely delighted with the professional way they have handled my assets offering solid and independent advice which has been prudent and reliable. Dealing with an experienced team with first class communication and speed of response when advice is required. They are a pleasure to deal with.

Sophie and I just wanted to thank you again for all your help in remortgaging. As ever, the service was superb and efficient, we will of course be coming back!

We have been using Jane at Ash-Ridge for the last 10 years, which literally speaks volumes for the service we receive. Jane’s honest and straightforward approach is a key part in ensuring we get the deal that is best for us. She is swift and always keeps us updated throughout the entire process whilst allowing us sufficient time to make a final decision. Jane is a first class mortgage adviser and I would recommend her to anyone seeking mortgage or financial advice.