More people than ever before are working for themselves and setting up businesses. It can be incredibly rewarding, but you also need to consider how it’ll affect your financial resilience.

The UK has a great spirit of entrepreneurship. According to the Office for National Statistics, around 4.8 million people (more than 15% of the labour force) is self-employed, and it’s something younger generations are continuing.

According to a report in Business Leader, 50% of new businesses set up between July 2020 and June 2021 were done so by people aged between 25 and 40.

And Generation Z, who are under 25, is already responsible for 7.8% of new companies.

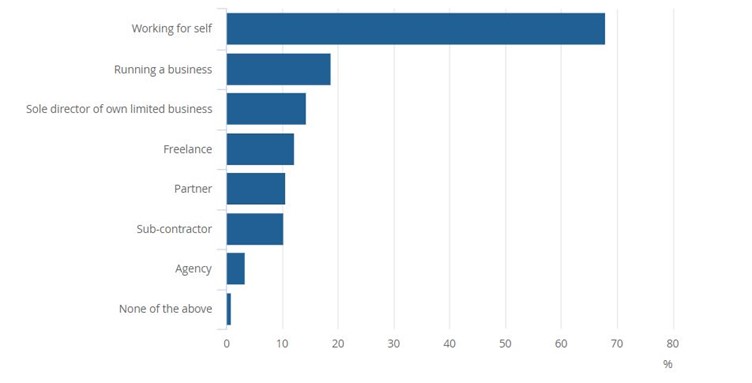

The data suggests that being self-employed is going to become even more common in the coming years. The graph below shows the different types of self-employment across the UK.

Source: Office for National Statistics

If you’re among those who are self-employed, taking these eight steps can help improve your financial resilience and long-term wellbeing.

1. Set personal goals

When you’re building up connections or starting a business, it can be easy for that to become your sole focus. However, personal goals are just as important and can help you live a more fulfilling life.

Personal finance goals, like being able to pay off your mortgage or retire early, can provide motivation and ensure you have a clear direction for life outside of work.

2. Review your budget

As you’ll be responsible for your income, understanding your budget is crucial. The questions below can help you track your cash flow and make informed decisions about your spending:

- How much are you making?

- Does your income vary?

- What are your essential expenses?

- How much are you saving regularly?

3. Consider income protection

While on the subject of managing your income, how would you cope financially if you became too ill to work? While no one wants to think about being involved in an accident or having a long-term illness, it does happen.

Income protection policies can provide a regular income if you’re not able to work. You will need to pay regular premiums, but it means you can focus on recovering should something happen to you.

How much your premiums are will depend on your health, lifestyle, and level of cover required, and it can be cheaper than you expect.

Despite this, a Nationwide Building Society poll found that 3 in 10 people had nothing in place to support them financially if they couldn’t work. Many others would rely on savings, borrowing from family or friends, or using a credit card or loan.

4. Review whether critical illness cover is right for you

As well as income protection, you may also want to consider critical illness cover.

This type of policy would pay out a lump sum on the diagnosis of illnesses named within the policy. It can provide financial security if you’re diagnosed with an illness like cancer, stroke, or multiple sclerosis. You can use the lump sum however you like, from paying off your mortgage to covering day-to-day costs.

Again, you will need to pay premiums and the cost will depend on your health, lifestyle, and level of cover.

5. Don’t neglect your emergency fund

Whatever your employment status, an emergency fund is important. It provides a financial buffer in case you face unexpected costs, such as repairing your roof after a leak.

If you’re working for yourself, it can also be a useful fund if you experience a slow period or need to take time off.

How much you should hold in an emergency fund will depend on your commitments and other assets. A rule of thumb is to have three to six months of expenses in a readily accessible account.

An emergency fund is vital for building financial resilience. Yet, a report in International Adviser suggests that 51% of UK adults do not have enough emergency savings. The poll found that it wasn’t just an issue for low earners either: 23% of households earning more than £100,000 said they couldn’t cover their essential outgoings for three months.

6. Set up a pension and make regular contributions

While most employees now have a pension opened on their behalf by their employer, entrepreneurs will need to take their own steps to secure their retirement.

Opening a pension and making regular contributions is a great first step to building long-term financial resilience. As well as your own contributions, your pension can also benefit from tax relief and will be invested to hopefully deliver growth over the long term.

Understanding if you’re saving enough for retirement can be difficult. We can help you create a retirement plan that suits your goals, and balances your spending now with the future.

7. Make the most of tax allowances

Managing your tax bill can help your money go further. As an entrepreneur, there may be additional tax allowances you can make use of now or in the future.

Business Asset Disposal Relief (BADR), for example, can be used when you want to sell all or part of your business, to reduce the amount of Capital Gains Tax (CGT) you pay. Or paying yourself dividends could reduce your Income Tax liability.

Understanding tax rules and which ones make sense for you can be difficult. So, seeking professional support can mean you’re better off financially overall.

8. Set up regular financial reviews

Finally, over time your goals and financial circumstances will change. Regular financial reviews can help ensure the steps you’re taking are still appropriate and support your wider goals.

To create a financial plan that will include frequent reviews to make sure you remain on track, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances. Levels, bases of and reliefs from taxation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate tax planning.